In the early 2000s, I was deep into my career in the energy industry here in Texas, and I was working to negotiate energy supply contracts for my employer. Wind power was starting to take off in the state; I had visited many sites throughout the state, met several teams of developers, and worked with my company’s dispatch center to integrate the new energy source into our operations. The new power source was unlike anything we had ever managed, so we had to be creative in our operations to adapt to it.

Many industry watchers and environmental groups advocated that a massive increase in wind power should be brought online, and some wanted a complete change to wind power and nothing else. At the time, however, only a few hundred megawatts of wind power had been constructed in Texas. Still, I spoke with groups, inside and outside the company, about this revolution. I tried to evoke an image of the state of the market then. “The demand for electricity in Texas right now,” I would say, “is like a huge eighteen-wheeler. But the amount of wind power available is like trying to get my son’s remote-controlled truck to pull it.”

Time has passed since then, and now the R/C truck would need to be nearly the size of a big Kenworth rig. That’s because wind energy provides a significant and irreplaceable portion of the energy supply in many markets across the U.S. So, if you’ve ever asked the following questions, we’ve got the answers for you.

- How significant was this expansion in wind energy?

- Where has the most investment occurred?

- What does the wind power future look like now?

Expansion of Wind Power in the U.S.

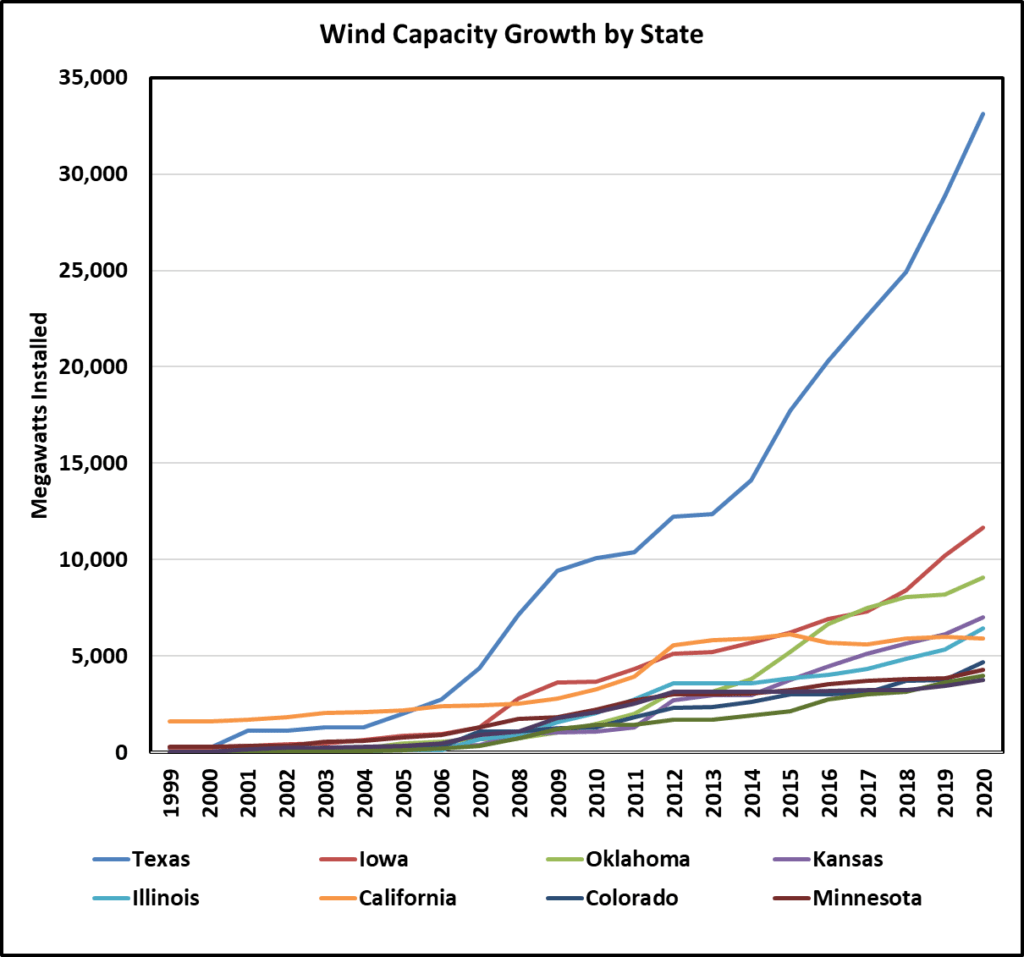

The story of the phenomenal expansion of wind energy in Texas is well known: 183 megawatts of total installed capacity in 1999 to over 10 gigawatts (GW) in 2010, then more than tripled to 33 GW in 2020. This amount is in line with the nationwide expansion of wind power from 2 GW to 122 GW over the same period.

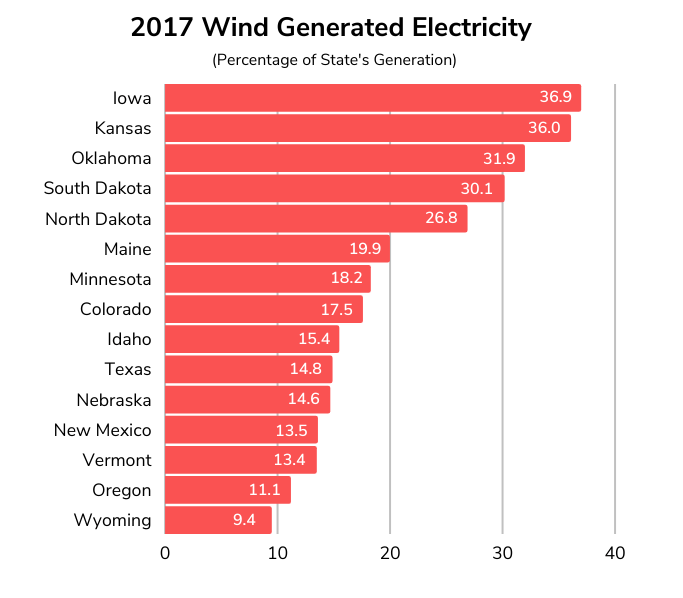

When it comes to the percentage of power produced by wind energy compared to all sources, the clear leaders are Iowa, Kansas, Oklahoma, and the Dakotas. The wind resources in these states are excellent: their topology, climate, and position in the center of the continent are all favorable factors in producing steady, reliable wind during most of the year. These are also smaller states with significant wind investments but comparatively lower electric demand than the power-hungry Texas economy.

Source: U.S. Energy Information Administration

Electricity Data Browser, 2017 Annual

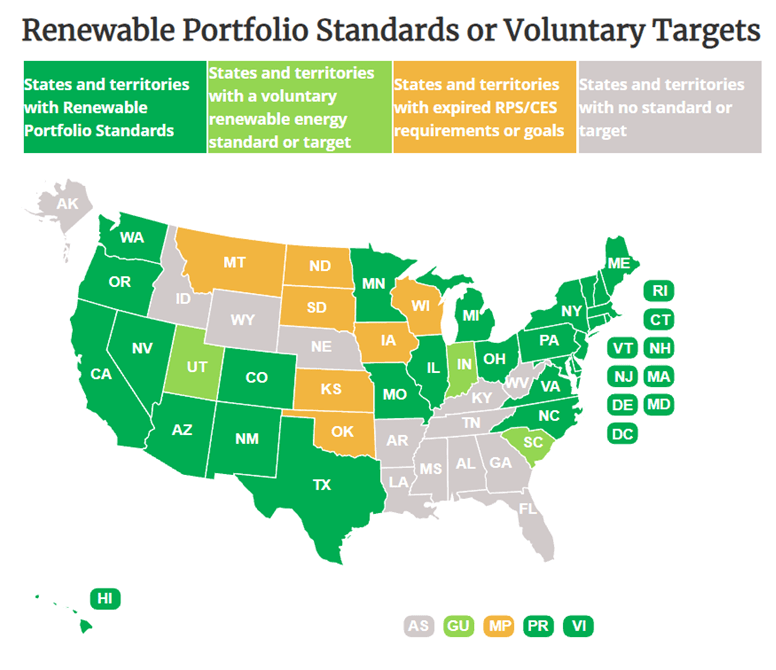

Much of this growth was assisted by various goals and incentives. For example, the federal production tax credit helped level the playing field between wind power in the U.S. and the cost of conventional power for many projects. In addition, various states have implanted Renewable Portfolio Standards (whether voluntary or involuntary) aimed at meeting specific goals by certain calendar dates.

Corporate commitments also spurred growth. Large companies would purchase the entire output from wind farms to offset their electricity use throughout the country. Also, wind power became competitive with prevailing fossil-fuel-based power prices in some areas, so a significant merchant investment has come about.

Future Wind Energy Investment

Is future expansion in wind power in the U.S. expected to keep up with the past two decades? The answer is yes. Several factors point to a bright future for wind energy:

1. After a slow start, the construction of offshore wind facilities appears to be about to take off. This technology has been extensively developed and improved in Europe but not so quickly in the U.S. due to the vast stretches of available land with great wind resources located onshore. Onshore construction and operations carry fewer risks and are much less costly. According to the Department of Energy, in late 2019, the offshore wind pipeline grew to over 28 GW.

2. Wind energy is now widely seen as a good investment. Advocates point out that wind is a carbon-free energy source and will have a central place in the future grid, hedging against coal or natural gas dependence. Also, wind energy is space-efficient, enabling continued use of the property beneath the turbine towers. Analysts cite meager energy costs from wind power, such as up-front capital costs and ongoing maintenance and operations costs, but there is no fuel cost. These costs have plummeted to levels below that of coal and gas-fired power.

Source: National Renewable Energy Laboratory (NREL)

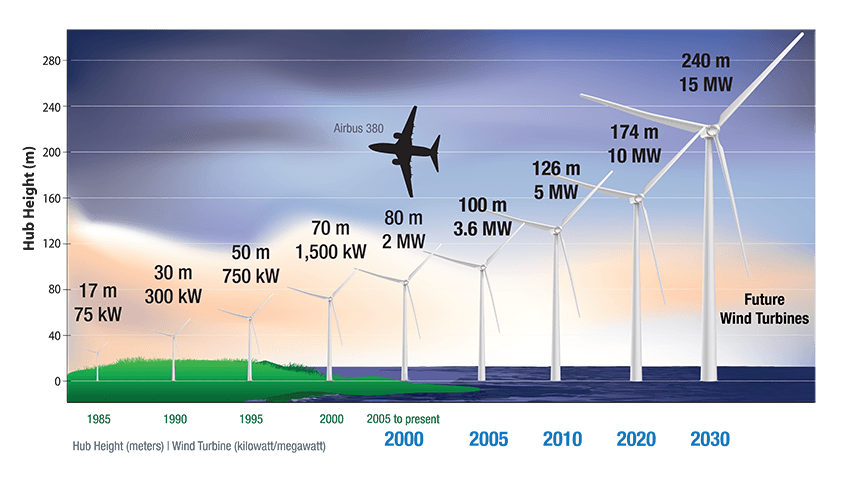

3. Technology improvements have drastically reduced the per-megawatt-hour cost of electricity produced by wind farms. For example, taller towers carrying larger turbines with much longer blades capture more energy from moving air. These enhancements translate into higher lifetime production, which drives down unit costs.

Conclusion

The expansion of wind power in the U.S. for electricity production has been one of the most significant trends in the energy industry in the last twenty years. No longer just curiosity, this power source is now a significant player in the worldwide industry. The move towards less carbon-emitting energy sources is a central objective of the industrialized world to stem climate change, and wind energy has made an enormous impact already.