When one thinks of large-scale battery energy storage as part of a dynamic electric grid, it’s easy to focus on the basic charge/discharge cycle – storing cheap energy off-peak and selling it at high prices on-peak. However, one can monetize several other sources of value from a battery. When combined with the energy dispatch, these add up to the total value expected from investing in this type of asset. This post will dive into these value streams, how they can be considered a suite of complementary services, and describe a few scenarios. While there are other energy storage technologies in existence, for simplicity, this post will focus on battery energy storage in the wholesale market.

Energy products

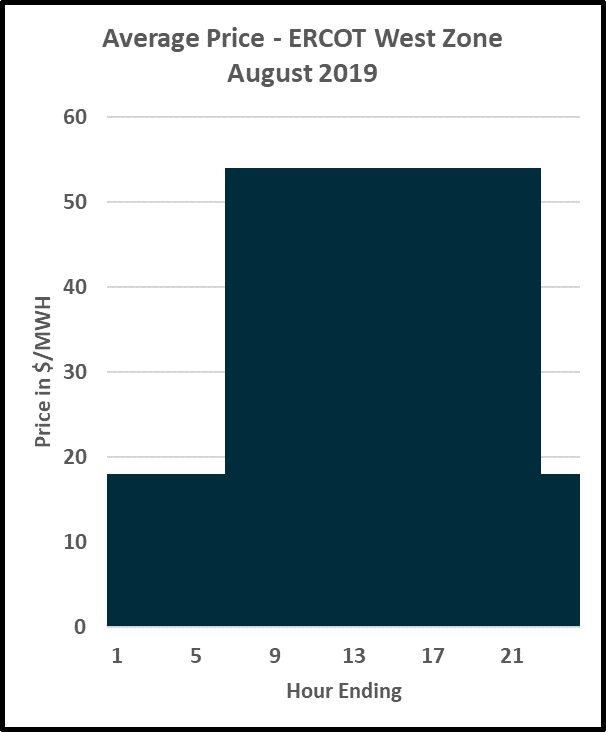

Many electricity markets experience large swings in spot prices from peak to off-peak. This price swing is especially pronounced in regions of hot summer weather with a high air conditioning load. Regions like Texas also experience large amounts of wind energy generation at night in summer. Thermal units do not want to come offline at nighttime just to start back up the next morning. All this leads to a glut of off-peak power, depressing prices relative to on-peak.

This environment is tailor-made for storage. For example, in August 2018, the Real-Time average price for ERCOT’s West Hub for the hours of 12 AM – 4 AM was near $18/MWH, where the average price from noon to 7 PM was over $54/MWH. Thus, using battery energy storage could have tripled its money simply on the day/night arbitrage.

But this wide on/off-peak spread doesn’t exist all year. Each battery operator must calculate a hurdle rate for participating in this daily shifting, but at some point, other alternatives may bring more value than energy price arbitrage. Also, even at the peak of summer, battery energy storage can capture value at other hours in the day besides the low- and high-priced peak periods.

Battery energy storage ancillary services

For many developers and owners, the value streams created by offering the battery energy storage into the market to supply spinning/responsive reserve, regulation, and fast frequency response have completed the picture of the total value of the asset. So let’s take each of these separately.

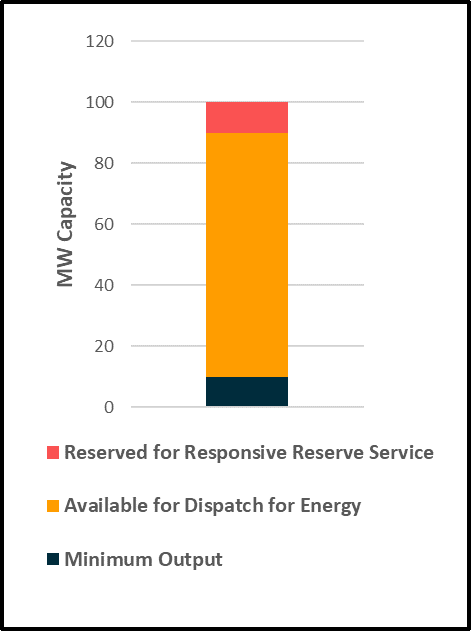

Responsive reserve

Also called Spinning Reserve, Responsive Reserve is a service purchased by the grid to maintain reliability throughout the day. A resource commits capacity for a certain period (usually in one-hour increments) to the grid to compensate for the potential loss of other units’ capacity. The committed resource is paid for this capacity, denominated in $ per MW per hour, but must respond with the total quantity within 10 minutes of deployment.

This Responsive Reserve capacity payment is a paycheck it will receive whether or not the unit gets deployed. If the unit is deployed for Responsive Reserve, it is usually during an emergency when prices spike, so there is a chance for a good payout on the energy it produces. However, the downside is that this capacity is reserved on the unit, so it cannot ramp up and capture high spot prices in the market when the unit has a Responsive Reserve commitment. Therefore, each owner must balance potential gains against lost opportunities.

How would you price your Responsive Reserve capacity? For a gas-fired combined cycle (CC) unit, the revenue from selling Responsive Reserve must be equivalent to what the unit could earn from selling the energy. For example, if the unit has an incremental cost of $21/MWH, and the wholesale power forecast for tomorrow is $26/MWH, the unit can earn $5 net revenue on the energy (the Spark Spread). Therefore, in this example, Responsive Reserve capacity prices must be at least $5 per MW per hour to make the owner indifferent to which alternative is chosen. In many markets, the economics of combined cycle gas tend to shape the power price curve, so in much of the year, Responsive Reserve prices tend to follow the spark spread of combined cycle power.

But what is the spark spread of a battery? Following the CC analogy, it should be the difference between the price of the energy used to charge the resource and the expected power market price, adjusted for the round-trip efficiency of the battery. For example, if your charging power price was $18, your efficiency is 90%, and your price forecast is $26, your spark spread is $26-($18/0.90) or $6/MWH. The expected price for Responsive Reserve must be at least $6 per MW per hour to make you indifferent to the alternatives, at least during the hours for which the comparison is made. Energy prices and Responsive Reserve prices change throughout the day, so this calculation must be made for each hour for which a choice is available.

Standby reserve

Like Responsive Reserve, Standby Reserve, or Non-Spinning Reserve requires the resource to be online and capable of deployment with longer lead times, typically 20 or 30 minutes. Combustion turbines and other quick-start units that need more than the 10 minutes required by Responsive Reserve are well-positioned to provide Standby Reserve. Batteries can also offer Standby Reserve, and the same evaluation process is necessary to value the capacity against possible revenues and opportunity costs properly.

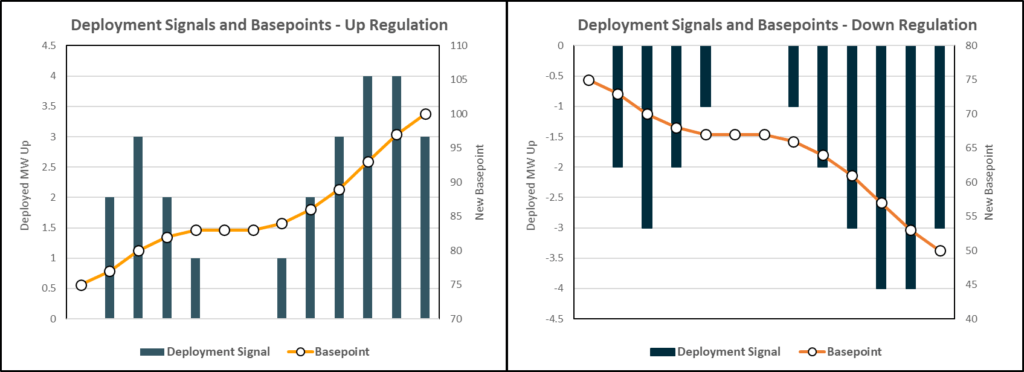

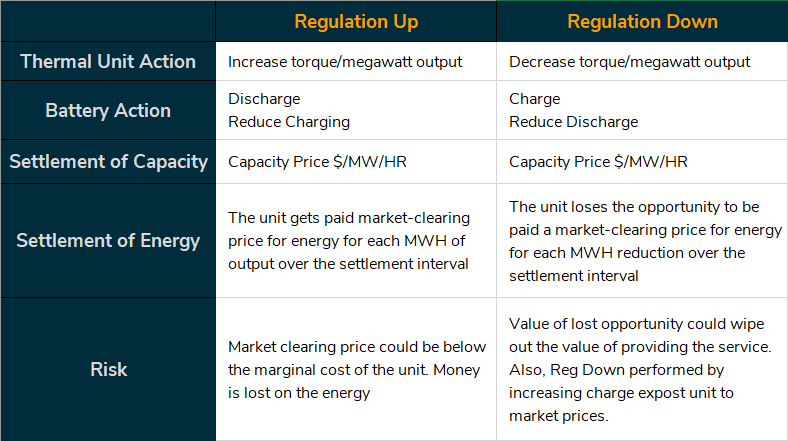

The grid procures Regulation Services to balance supply and demand, so the system stays within tight frequency bounds. A unit provides Regulation Up by increasing generation or reducing load, and Regulation Down by reducing generation or increasing load. An ISO may procure these services together or separately, depending on the market.

A thermal resource provides Regulation Up or –Down by following signals from the grid operator to either add or reduce torque onto its turbine/generator to raise or lower megawatt output. Increasing megawatt output helps to increase the frequency of the system while decreasing megawatts helps decrease frequency. However, in electric steam plants, these actions involve mechanically increasing steam flow to massive turbines. There is a delay between the command to increase flow and the actual torque increase, so the deployment signals are usually spaced about 4 seconds apart. Grids have found that solid-state resources like batteries can respond much faster to frequency deviations, so they procure Fast Responding Regulation Service from these resources. Resources are required to respond to the signal within 15 cycles or a quarter of a second. Some markets procure a specific portion of their overall Regulation Service using Fast Responding Regulation Service, which has created a market almost exclusively for batteries.

In any case, there are some subtleties to factor into the offer strategy for regulation services. For example, a thermal unit providing Regulation Up will be asked to increase torque (output) by giving a base point. This point is the new megawatt level the grid needs the unit to achieve in the next interval (4 seconds). The dispatch algorithm will ensure ramp rates of the unit are honored and will only give achievable base points. Thus, for battery energy storage to provide Regulation Up, it can either increase the discharge of energy from the battery (increasing output, like the thermal unit) or reduce the amount of charging it is currently engaged in (reducing load). The reverse is true for Regulation Down.

The subtlety of the regulation services is that different risks are introduced depending on the operational approach and prevailing energy prices at the time of deployment. Although the unit is being paid a capacity price for the service (denominated in $ per MW per hour), the unit will also earn revenue on the energy produced (in the case of Regulation Up). This energy revenue may not cover the marginal cost of the unit.

In the case of Regulation Down, the unit could incur actual or opportunity costs for deployment, depending on whether the service is accomplished through decreased output or increased charging. Being deployed downward by reducing output in a high-priced market creates an opportunity cost that may overwhelm the capacity payment.

If the Regulation Down service is being accomplished by increased charging, and the signal comes at a time when prices are low, battery energy storage can charge at low prices while being paid for the regulation service at the same time, a good outcome. However, if Regulation Down is being performed by increased charging and the market price is high, the unit could experience losses far more than the gains in selling the ancillary service itself. Therefore, these risks should be priced into the ancillary service offer.

Black start service

Another ancillary service available in many markets is Black Start Service. This service is managed differently in each market, but it centers on the ability of a power generation unit to start up without the need for grid power. Small combustion turbines, reciprocating engines, and the like can perform this function. Batteries can also perform this function, but an extended re-start of an entire grid could take days or even weeks, so batteries may not have the capacity to qualify in most markets. However, while they may not qualify for a Black Start, batteries have demonstrated the ability to start up a thermal unit that can provide Black Start grid services.

State of charge implications

Much of this discussion has ignored the management of the battery’s state of charge, which is crucial to optimizing its multiple value streams in the market. In most markets, the state of charge of the battery is continuously telemetered to the grid. This amount is input into the network dispatch model to keep the grid constantly updated on the available resource quantity and ensure the battery energy storage is not deployed beyond its limits. In addition, in some markets, the battery owner is responsible for managing its state of charge, deciding which hours to charge, and providing energy or ancillary services. In other markets, the grid operator has the option to do this.

Conclusion

We’ve looked at how batteries can provide energy and ancillary services to the grid and some business and economic analyses necessary to optimize it. Because load patterns, prices, and other factors change throughout the year, any single strategy will not suit all days. As a result, operators and owners must constantly re-calculate and re-assess their approach.

Furthermore, we looked at this asset as a single resource. A portfolio of batteries requires more value streams to be analyzed, such as its ability to firm up renewable energy or shift ancillary service obligations between units to better position the portfolio in the market.

The next article will focus on distribution-connected energy storage and perform a similar deep dive into the value streams they present. Finally, a look at behind-the-meter storage will also help round out our overview of energy storage analysis.

Terms to know

Responsive Reserve: Also called Spinning Reserve. The capacity was deployed within a short period to help the grid cope with a significant loss of generation capacity.

Spark Spread: The difference between the cost to produce a unit of energy (typically a megawatt-hour) and the sale price.

Regulation Services: This occurs when a generation unit follows a deployment signal from the grid operator to either raise or lower output to help the entire system stay at or near a frequency target like 60 Hz.

Fast Responding Regulation Service: This regulation service responds quickly, about 15 cycles or a quarter of a second. This response is usually only possible with solid-state resources like batteries (a subset of Responsive Reserve in some markets).

Black Start: An ancillary service used by many electric grids to secure the ability to restart the system in the case of a blackout. A Black Start unit must be able to start up and generate power using no other outside source of electricity. These units are regularly tested to ensure this capability, and the grid operator holds auctions to procure the capacity.

State of Charge: For a battery, the current portion of its total capacity, e.g., 55% state of charge of a 100 MW battery, is 55 MW.

You May Also Be Interested In:

- BATTERY STORAGE IS CROSSING THE CHASM… QUICKLY

- THE EVOLUTION OF MARKET OPTIMIZATION IN THE RISING BATTERY ERA