“Will I keep my job for long?”

The question entered my mind one month into a new career at Florida Power Corporation in St. Petersburg in 1998.

FPC’s Power Marketing Architect, Mark Cardinale, had just completed writing code that automated nearly every step of real-time energy trading and scheduling.

Entering bids and offers into the Florida Economy Broker Network (EBN), ordering transmission, creating a NERC Tag, and entering the deal in our Nucleus ETRM solution became an automated task done in seconds.

Mark even added some audio delight to the process by having our computer automatically play Pink Floyd’s “Money” after all matches in the broker screen.

Like everybody else, technology did not take away my job for the next 24 years. It just redefined it.

As for my friend Mark, he moved to Norman, Oklahoma, and helped revolutionize energy trading software across the nation at PCI.

As I watch the creation of the Southeast Energy Exchange Market (SEEM) unfold, my 1998 memories come back to me, along with other experiences throughout my career in the energy industry.

My blog post aims to share six lessons learned that I believe will spell success for SEEM and those participating in it.

1. Know Your True Production Cost

To successfully participate in an exchange market, you must know your actual production cost for each generation resource.

Sounds simple and easy. But do not assume everybody in your company is singing from the same sheet of music.

Throughout my experiences over the years, I discovered that Accounting often owns one understanding of production costs, Finance has another, and the Control Center also has one. Of course, the Marketing desks always have an opinion.

Before you participate in an exchange market, take the time to make sure everybody is on the same page.

2. Submit Your True Production Cost

Once you identify your actual production cost, you need to ensure you submit that cost every 15 minutes.

Try to avoid adding “adders” to your production cost.

Why is this important?

Your actual production cost will provide your highest chance to sell your excess generation or purchase power below your production cost.

Why is this important?

Using your true cost is the best way to derive and calculate the cost, reliability, and environmental benefits from SEEM.

Trying to “outsmart the market’ will be an exercise in futility and lower your liquidity in SEEM.

3. Bilateral Trading Will Not Go Away

Bilateral trading in the southeast will not go away for various reasons.

The advent of massive amounts of utility-scale solar power will increase the already tricky and delicate task of balancing generation and load.

The humidity and associated cloud cover typical to the southeastern U.S. introduces new risks to solar forecasts for SEEM participants.

The size of these risks guarantees that very few, if any, market participants will choose to rely solely on SEEM to handle generation deficits. In fact, some risk policies will likely not permit it.

On the flip side, very few market participants will not want to risk shutting off resources if SEEM does not pick up large excesses of surplus generation.

To reduce these risks, bilateral trading will not go away.

You can reasonably expect real-time transactions to trade at a $2-4 surplus to reduce the risks.

People value certainty.

Speaking of which …

4. SEEM Will Not Provide Certainty

SEEM will deliver monetary, reliability, and environmental benefits to the southeast region.

SEEM will deliver a forum for participants to determine their journey to integrate renewable energy reliably and cost-effectively.

But it will not deliver certainty in real-time.

Real-time markets exist because day-ahead load and generation forecasts are never perfect.

So, SEEM cannot provide certainty when mitigating risks to balance load and generation deficits and surpluses in real-time.

The uncertainty is a big reason why bilateral trading will not go away.

5. Never Forget Why SEEM Was Created in the First Place

During the past six months, there has been much debate regarding the calculated future monetary benefits of SEEM.

But little talk has centered upon the massive growth of utility-scale solar generation and the associated reliability challenges.

SEEM became a reality because the Southeast region needs to coordinate to integrate massive solar generation cost-effectively and reliably.

The future successes of SEEM will be interpreted from a much broader scope than simple annual cost savings.

Integrating solar generation to accomplish public policy goals will be a crucial measure.

So will keeping the air-conditioning on and the post-COVID-19 economic recovery be on track?

6. Keep It Simple

Speed is critical when it comes to successful participation in SEEM. Unfortunately, complexity is never a friend of speed.

Automated workflows will best handle the challenges of SEEM participation every 15 minutes.

And it will work even better when the market eventually moves to a five-minute level of granularity.

Speed never has a slump.

It’s better to learn to crawl before you walk. Keep your business process plans as simple as possible during the first few months of learning. Each system has unique operating characteristics, and the playbook will differ for everybody.

When it comes to the organizational structure of SEEM, simplicity will offer the best ingredient for the region to collaborate and address challenges that we do not yet know.

Regional coordination doesn’t have to mean sacrificing speed and responsiveness for greater efficiency.

Simplicity always delivers.

Coming Full Circle

It’s so funny when things come full circle.

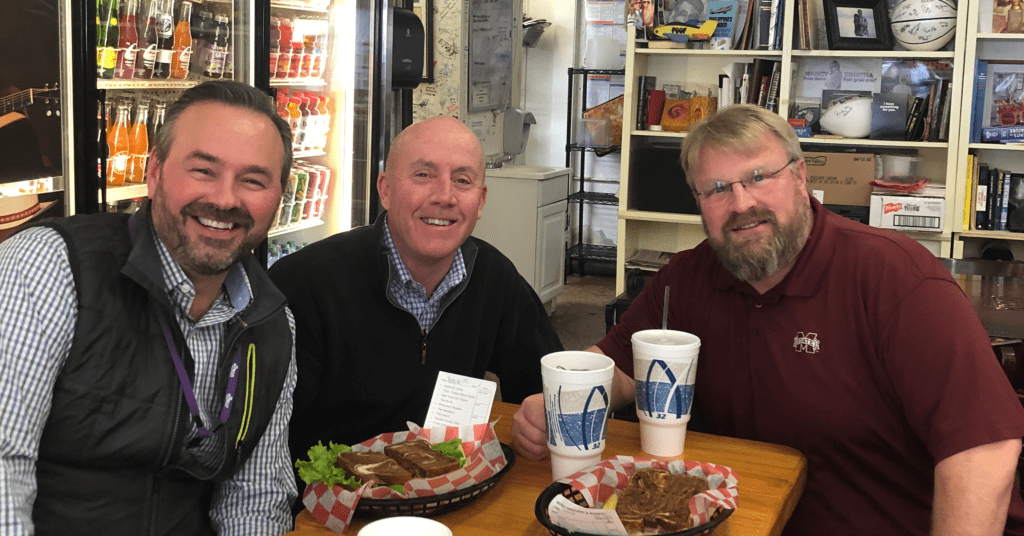

Twenty-four years later, I find myself working again with my old Florida Power Corporation colleagues, Mark Cardinale and Scott Quinn.

We’re still working on automating energy trading business processes.

Technology never eliminated my job. On the contrary, it allowed me to work on higher-value activities and be more fulfilled.

As I work with my PCI colleagues to help people prepare for SEEM, I draw upon my prior experiences to help me envision what everybody is trying to determine.

What will tomorrow bring?

Am I right?

Only time will tell.

Check out PCI’s “Reasons Driving the Creation of SEEM” blog post for more information about SEEM.