The U.S. is on the path to a future powered by renewable energy. Wind and solar penetration of the electric grid grow each year, but things simply aren’t moving fast enough. The climate change clock is ticking, decarbonization deadlines are quickly approaching, and the renewable infrastructure won’t be ready in time. Hydrogen can be the bridge that gets us to our future energy state.

Hydrogen is the most abundant element on Earth. It’s versatile and can provide a path to decarbonize our existing infrastructure today while also solving reliability issues with tomorrow’s renewable energy sources. Industry leaders recognize that the future of hydrogen is bright; from traditional oil and gas companies to integrated conglomerates like NextEra, the big players are investing in hydrogen like never before.

The challenge is that hydrogen doesn’t exist as a gas; you have to extract it from something else, which can be both a costly and carbon-intensive process. So how do you evaluate the economics of green, blue, and gray hydrogen? You need a way to convert the colors of hydrogen into investment-grade data in terms of both cost and carbon intensity.

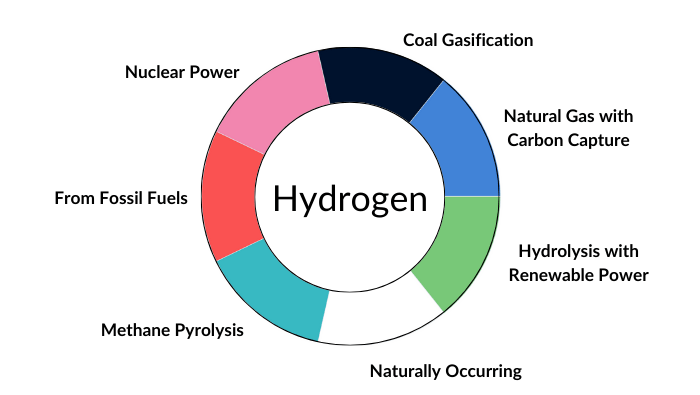

The colors of hydrogen

There are seven commonly accepted colors of hydrogen: black/brown, gray, green, blue, turquoise, pink, and white. Each color is based on the carbon intensity of the production process or the amount of greenhouse gas emitted for every kilogram of hydrogen produced. We’ll spend our time in this article looking at gray, green, and blue.

What is gray hydrogen?

Gray hydrogen is produced by breaking down fossil fuels like natural gas. This is primarily accomplished via steam methane reforming (SMR). As the name suggests, SMR breaks methane (natural gas) apart by using high-pressure steam at temperatures between 1,292 degrees Fahrenheit (700? degrees Celsius) and 1,832 F (1,000 C). This catalytic chemical reaction produces separate hydrogen, carbon monoxide, and carbon dioxide molecules.

The challenge with this process is that it produces a significant amount of carbon dioxide — by some estimates, 9-12 tons of CO2 is produced for every ton of hydrogen. These emissions are most often vented unabated into the environment.

SMR has historically been the cheapest way to produce hydrogen, though costs are directly tied to the price of natural gas. In recent months we’ve seen the war in Ukraine and other factors send natural gas prices higher than they’ve been in recent memory. Nobody knows how long the price of natural gas will be in flux, so while Platts Hydrogen Price Wall reports around $2/kg for gray hydrogen, ultimately, rising natural gas costs could upend the market.

What is blue hydrogen?

Another color of hydrogen is blue. Blue hydrogen — the cleaner, more sustainable version of gray — follows the same SMR production process to break natural gas into its primary components. The difference is that with blue hydrogen, a carbon capture and storage system (CCS) is added on; rather than venting into the atmosphere, the carbon emissions are stored underground. Blue hydrogen is considered low carbon since up to 20% of what’s generated cannot be captured.

While there are significant environmental improvements when moving from gray to blue hydrogen, the primary feedstock is still a fossil fuel. In addition to the environmental issues, the price of blue hydrogen is still entirely dependent upon the price of natural gas. The final price per kilogram will depend on the technology used, the scale of the operation, and the proximity to a CO2 storage solution, but the CCS component makes blue hydrogen more costly to produce than gray – nearly double at $4-$5/kg, according to Platts.

What is green hydrogen?

Green hydrogen, which is made without any greenhouse gas emissions, is the most sustainable production process of the three we’re evaluating. Zero-carbon renewable energy sources like wind and solar separate hydrogen from water via electrolysis. For a more detailed explanation of electrolysis, check out the blog post, “Obtaining Clean Hydrogen Is a Critical Step Toward Clean Energy Goals.”

Proton Exchange Membrane (PEM) and Alkaline are the two most common types of electrolyzers. Alkaline is more widely used and is cost-effective at $4-$5/kg of hydrogen. According to Platts, PEM is more efficient and has better ramp rates but is more expensive at $5-$6/kg.

With rates ranging between $4 and $6 per kilogram, green hydrogen is more expensive to produce than blue or gray. That said, as technologies improve and the costs of renewable energy continue to decline, green hydrogen is expected to become more financially viable, especially if natural gas prices continue their march upwards.

The business case for green hydrogen

The environmental case for green hydrogen is clear. What’s less clear is the business case. Final investment decisions (FIDs) are one of the major things holding the hydrogen industry back. Developers and investors need a way to understand 10- and 20-year projections for green hydrogen to make informed decisions about when and how to invest.

Here are two examples of green hydrogen hubs in development that will serve as models for the rest of the country.

Mississippi clean hydrogen hub: Hy Stor Energy Project

The Mississippi Hy Stor Energy Project is one of the first green energy hubs in the region. The project is expected to produce around 110 million kilograms of green hydrogen each year, 70 million kgs of which will be stored in the region’s naturally occurring underground salt caverns. All aspects of the production process will be done across multiple sites interconnected by more than 200 miles of pipelines.

The green hydrogen the hub produces can be used in various ways, including for electricity generation and as a replacement for fossil fuels in trucks, ships, and trains.

Storage will be a vital component of the hydrogen hub. In our current environment, the stored hydrogen can be used during extreme weather events when other generation sources aren’t available. In our future state, storage will play an even bigger role when the grid is more reliant on intermittent renewable energy sources. The simple fact is that sometimes renewables generate more energy than we need; we can use that excess energy to create green hydrogen and store it underground in pressurized salt domes to be released via pipelines when needed – like during overnight hours when solar panel generation drops off.

Advanced Clean Energy Storage (ACES)

The Advanced Clean Energy Storage (ACES) hub is a partnership between Mitsubishi Power America, Intermountain Power, the Los Angeles Department of Public Works, and the Western Green Hydrogen Initiative. ACES will convert a coal plant at Intermountain Power’s Delta, Utah, facility to a combined cycle 840-megawatt hydrogen-capable natural gas plant. It will capture and convert excess renewable energy into green hydrogen, which it will then either store in salt caverns or deliver to customers in the power generation, industrial, or transportation sectors.

The project will start with the 70/30 natural gas-hydrogen blend, eventually transitioning to 100% hydrogen. As with the Hy Stor project, ACES will use salt cavern storage for 5,500 metric tons, or 300 GW hours, of storage.

What sets ACES apart is that it’s a utility and industrial scale hub that aims to decarbonize the entire western U.S. by integrating with the Western power grid and interstate gas transmission system.

Final thoughts

At PCI, we’re hard at work on our next generation of software that will help investors and developers evaluate the economics of each color of hydrogen. We aim to create a single platform that will consider both the price of production and the carbon intensity of each, allowing you to make informed investment decisions on your path to green hydrogen.

Companies will need tools such as PCI’s GenTrader portfolio optimization software, ETRM solution, and Hydrogen optimization software to manage the physical and financial positions in order to fully capture cross-commodity arbitrage opportunities, effectively mitigate commodity price risks, and achieve net-zero emissions in the future.

On Thursday, Nov. 16., we hosted a webinar on green hydrogen. Request the slides to hear from PCI experts on tech advances in green hydrogen production and how you can stay up to date on this evolving market.