A thermal power plant is an option to convert fuel into electricity when profitable. Power and gas markets are both well known for this. Plus, exposure to multiple volatile markets amplifies uncertainty, thus increasing option value.

Wind and solar generators have little control over when they run- they are price takers of a single commodity built to produce as much as possible when ambient conditions allow, even when prices are low. Their value is more intrinsic (in the money) than extrinsic, like that of a dispatchable power plant.

Batteries provide more option value to renewables by storing energy to sell at more attractive prices and participating in ancillary service markets, like thermal plants. That’s a huge benefit, and storage is growing exponentially. Lithium-ion batteries are today’s go-to but are becoming more difficult and expensive to obtain. Fortunately, more scalable and longer-duration storage innovations are on the horizon.

Electrolyzers: the battery alternative

An alternative to batteries is an electrolyzer – an industrial facility that uses electricity to produce hydrogen and oxygen from water. An electrolyzer can provide many of the same benefits as batteries but adds option value by enabling it to operate in a new commodity market. With an electrolyzer, wind or solar farm has the option to make either hydrogen or power. This increases revenue and lowers risk by diversification (adding a less correlated option) to the portfolio. Like batteries, it practically eliminates curtailments since there is always something useful to produce from excess power. It also enables participation in ancillary service markets such as regulation and long-duration storage for grid stabilization.

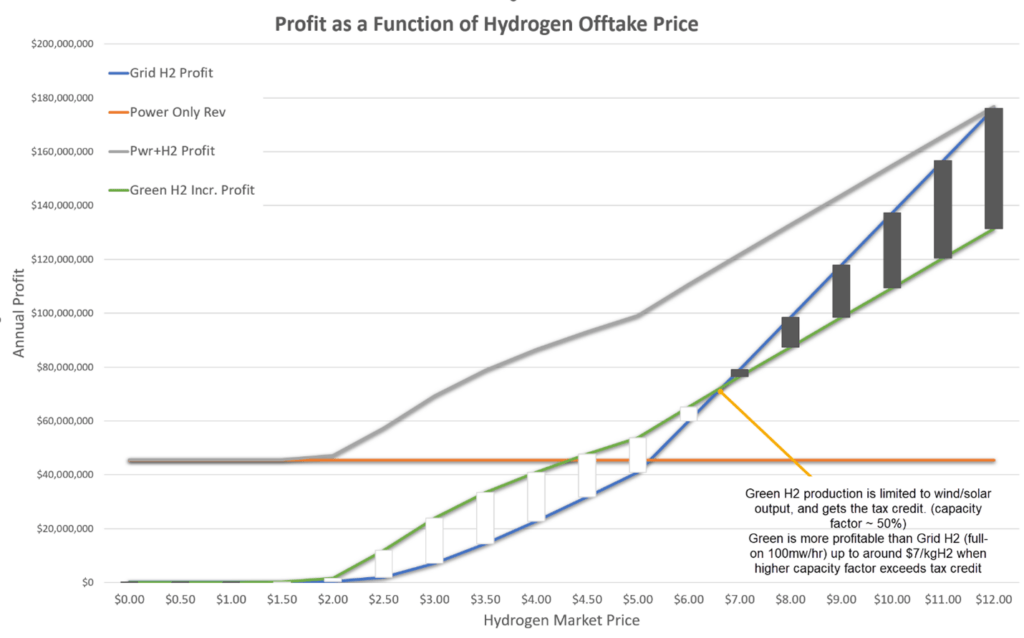

To illustrate, let’s look at a hypothetical 100 MW electrolyzer operating in ERCOT. Using hourly ERCOT wind, solar, and DA LMP data from 2021, the facility is modeled so that each hour the renewable output is allocated to whichever commodity is more profitable, the grid or hydrogen plus grid services. Let’s also suppose the facility uses Proton Exchange Membrane (PEM) electrolyzers, which, while more expensive, are better able to handle renewable intermittency and ramp down fast enough to provide regulation to the grid.

Finally, let’s imagine the facility compresses and stores the hydrogen in tube trailers at an annual off-take price. According to this 2021 ERCOT scenario, hydrogen market prices as low as $3.50/kg can recover the electrolyzer investment within about three years, thanks in part to the $3/kg H2 production tax credit (PTC) announced recently as part of the Inflation Reduction Act (IRA). Indeed, these results indicate that producing green hydrogen can be profitable even at today’s PEM electrolyzer capacity prices in the $1000/kW range.

Hydrogen production and uses

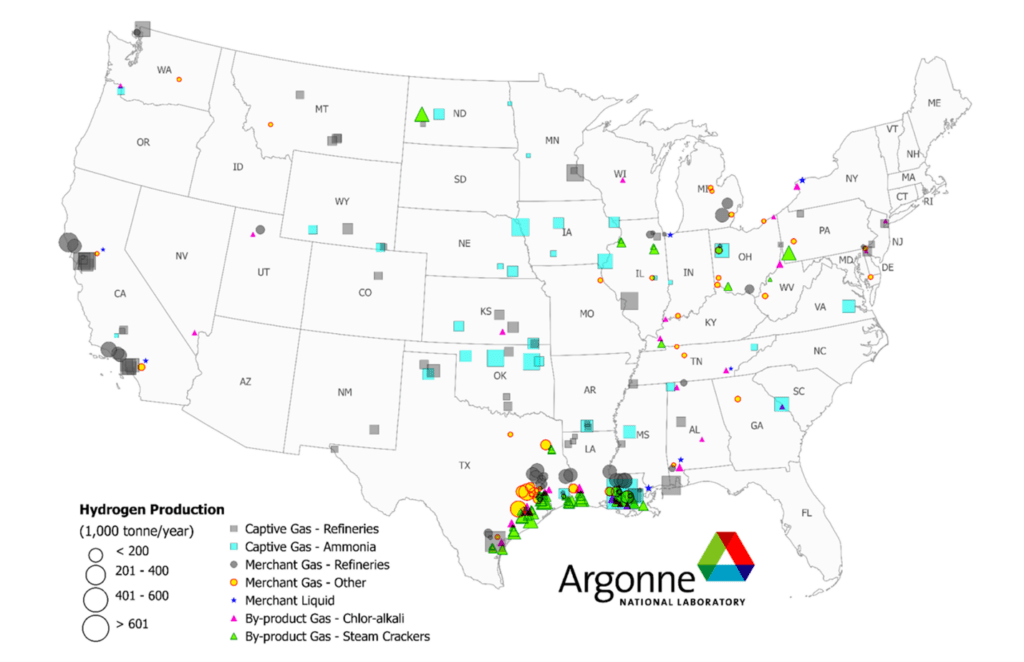

The Argonne map below shows the current annual hydrogen production of 10M metric tons, with 95% coming from steam methane reforming (SMR). Displacing carbon-intensive hydrogen with green hydrogen is a critical first use case for scaling and integrating hydrogen into existing energy and power infrastructure and emerging markets.

Hydrogen has many downstream uses and can help decarbonize other industrial processes, such as making fertilizers, steel, and petrochemicals. Shipping and aviation are actively experimenting with hydrogen-based fuels. Electricity storage is another viable option for hydrogen when coupled with fuel cells and gas turbines with hydrogen blending capability. Other forms of storage may be more electrically efficient, but none bring the option value of hydrogen or the “sector coupling” that makes hydrogen the most versatile carbon-free fuel available.

Today, natural gas is used to produce around 95% of the world’s hydrogen (considered “blue” if carbon is captured, else it’s classified as “gray“), so not surprisingly, the price has skyrocketed, topping $16/kg. As a result, the combined renewable-electrolyzer plant is not only more diversified but also more profitable than renewables alone. These results don’t account for operational risks inherent in budding technologies, which is why the tax credit is warranted.

Hydrogen economy

As renewable costs continue to drop and regulators demand more clean energy solutions, we must develop innovative solutions to integrate elevated levels of variable renewable energy into the grid. Batteries are good, but electrolyzers are emerging as an even more versatile and valuable option because they serve many purposes.

This is how the hydrogen economy starts. The PTC makes green hydrogen cost-competitive with gray by enough margin to spur investment, which it appears to be doing very well. But even before IRA passage, a joint McKinsey/Center for Houston’s Future report recognized “Houston as the epicenter of a global clean hydrogen hub.” Rich in renewables and plenty of uses for hydrogen, the case for green hydrogen in ERCOT is solid. The results from my 2021 ERCOT analysis line up nicely with those in the Houston report and this recent piece by Rethink.

Obviously, a more rigorous analysis must consider more than one year of sample data, and many other factors go into techno-economic analysis. But this demonstrates that a more rigorous analysis is worth considering.

Request materials from our webinar, “Option Values: Unlocking Green Hydrogen at Scale,” to learn more about the value proposition of green hydrogen production.