As if we did not have enough challenges and uncertainties in the final months of a global pandemic, we are receiving an unexpected farewell gift: skyrocketing electric bills.

Why is this happening?

Supply and Demand

Supply is the quantity of a commodity made available by the producers to its consumers at a specified price.

Demand is the desire of a buyer and their ability to pay for a particular commodity at a specific price.

Today, global demand for natural gas is soaring, and supply is woefully lacking.

“There are snakes that go months without eating. Then they finally catch something. But they are so hungry, they suffocate while they are eating. One opportunity at a time.”

Don Draper / Mad Men

In many ways, the reawakening global economy is like the suffocating snake.

Thanks to nearly two years of anemic economic activity due to COVID-19, the world went months without consuming our traditional amount of natural gas.

But the V-Shaped economic recovery now has the global economy so hungry for gas and oil; we are suffocating on supply chain challenges experienced by nearly every commodity.

Many folks now realize that electricity does not come from the wall.

Even though the United States introduced the Shale Revolution in 2006 and brought energy independence along with a tsunami supply of oil and gas, we are not immune to the current price shock of today’s energy markets.

Just look at your latest utility bill.

What You Will Learn In This Post

In this PCI blog post, we will cover:

- Why is my power bill so high?

- How long will this likely last?

- What will be the long-term impacts?

One thing we knew yesterday, we know today, and we will know tomorrow.

If you want stable prices, you need production to meet demand.

Not government intervention.

Why Is My Power Bill So High?

Capital has a funny way of flowing to places where it feels most welcomed.

So does natural gas.

Liquefied natural gas (LNG) prices have jumped from record lows to record highs in less than a year and a half, with the market first suffering from the pandemic’s impact and now struggling to keep up with a global recovery in demand.

Economic resurgence, combined with a chilly northern hemisphere winter and a scorching summer, boosted demand while production issues hindered supplies. Moreover, recent power cuts and outages in China due to coal shortages have only increased the struggle for energy sources between Asia and Europe.

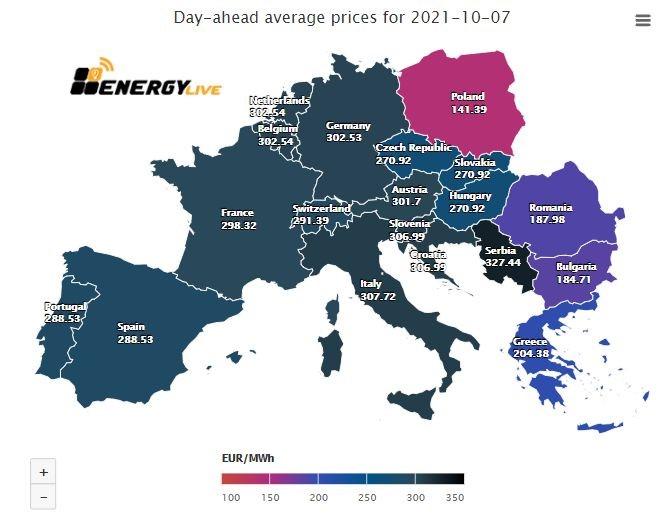

As a result, LNG prices recently surpassed $34 per million British thermal units, up from just under $2 MMBtu in May 2020, while European gas prices are up 300 percent this year.

At the pandemic’s beginning, natural gas and oil drilling were drastically curtailed because no demand existed. But, unfortunately, it is not so easy to stop drilling and then begin again very quickly.

So when the economy began to recover once the vaccines became available and distributed quickly, the demand for natural gas soared while the supply remained severely limited.

We became like the snake that had gone months without eating and then tried to eat too much too quickly.

Abracadabra. Hocus-Pocus. Hello, energy price shock.

Even in the land of abundant shale supplies, prices are rising.

How Long Will This Last?

Somebody once asked me, “How good is your Locational Marginal Pricing model?”

I replied, “If it were perfect, I would not be here selling it to you. I would be trading on it for myself.”

You can learn more about How Locational Marginal Pricing Works in this blog post.

Nonetheless, we need forecasts to establish budgets. Residential and commercial entities need to estimate energy costs to run households and businesses.

When I need a forecast, I turn to my good friend and energy industry expert, Mike Zaccardi. Mike has a knack for looking at the big picture and relying on charts and data to share insights.

“How long will these high energy prices last?”

Natural gas is a commodity, after all, and so Mike naturally decided to first look at the big picture of commodities.

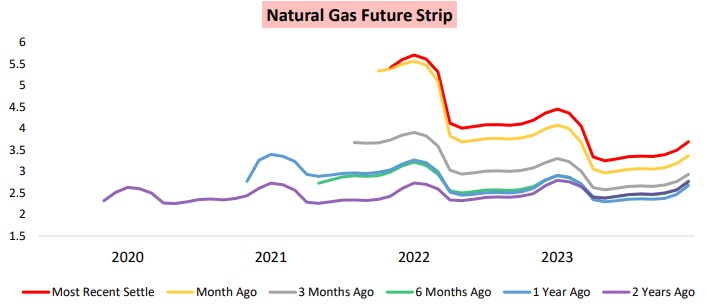

What about natural gas?

Natural Gas Future Prices ($)

Source: Bespoke Weather

There is extreme backwardation in the natural gas futures market–near months trade at a massive premium to outgoing months. Still, there has been a rally in future years. The market expects natural gas to be in the $2.75-$3.50 range in the coming 3 to 6 years.

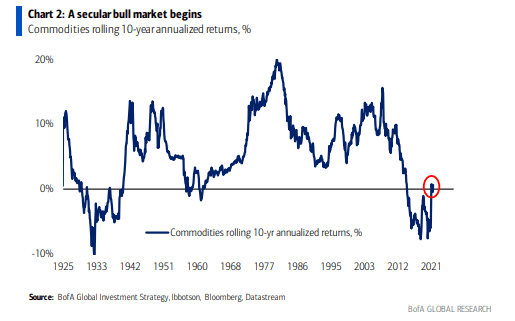

According to Mike, “There is a reasonable likelihood that commodity prices, namely energy prices, are in the early stages of a long-term upward cycle. But, fundamentally, years of under-investment and a lack of CAPEX have left the old economy in relative shambles compared to the digital economy.”

“From a technical perspective, the Bank of America chart indicates commodities have begun a new bull cycle. Previous cycles lasted many years–even decades.”

“The year to hedge natural short positions was 2020. Those generational cheap prices are gone. Market psychology is changing too. Traders, funds, and even politicians are quickly realizing that elevated energy prices appear here to stay. While the market will find its footing in the coming months, a new energy bull market might already be underway.”

The acceleration of renewable energy integration coupled with the elimination of coal will increase demand for essentially the only fuel available to handle the intermittency of wind and solar power.

One more development should solidify the bull market for energy.

The “Electrification of Everything.”

According to a study from Princeton University, electrifying nearly all transport and buildings could contribute to doubling (or more) the amount of electricity used in the U.S. by 2050. That would lift electricity’s share of the total energy used to close to 50% from about 20% today.

It looks like higher energy bills will be here to stay in the future.

Long Term Impacts

Rising electric bills pose both short-term and long-term challenges.

Almost all states have executed extended moratoriums on utility disconnections because of COVID-19.

“Many homes found themselves unable to pay electricity, water, and telecommunications utility bills, resulting in potentially substantial utility debt and financial repercussions to utilities,” according to a report by the National Governors Association.

Low-income households may have dug themselves a deeper hole because of the moratoriums: they still owe back bills that have been stacking up, leaving them with possibly insurmountable debt.

In late 2020, electric and gas utilities had $32 billion in arrears, with up to 20% of homes behind on utility payments. As a result, thousands of dollars in arrears have piled up in the accounts of many low-income households.

How will utilities address these unpaid balances? The question becomes more complicated as time passes by and precedents become set.

Somebody will need to pay for these imbalances.

How will low-income households fare in a new era of substantially higher power bills?

How will these bills impact the teleworkers staying home and absorbing a power bill double or triple in the future?

A Post-COVID-19 Energy Industry

Haruki Murakami once said, “When you come out of the storm, you won’t be the same person who walked in. That’s what this storm is all about.”

The energy industry in a post-COVID-19 world will not be nearly the same as before the declaration of a national emergency on March 13th, 2020.

The clear evidence of this transformation will be written in our energy bills for the next decade, perhaps longer.

Higher energy bills will spur conservation and, ultimately, digital solutions to control costs.

The pilot has turned on the “Fasten Seatbelts” light as turbulence lies ahead.