In January 2018, PJM formed its Energy Price Formation Senior Task Force (EPFSTF) to serve as a forum for stakeholders to discuss how Energy and Reserve Markets can be enhanced for better alignment of prices to improve the reliability and resilience of the grid. PJM’s Board has reviewed the evidence that demonstrates that when the system is experiencing stressed conditions, energy and reserve prices do not accurately reflect PJM operator reliability actions. As a result, out-of-market payments increased substantially during those periods.

At the directive of its board, PJM is actively seeking to arrive at a consensus on six components to meaningfully address its reserve procurement and pricing issues by January 31, 2019. Each component is outlined below.

1. Consolidation of Tier 1 and 2 Synchronized Reserve products

PJM proposes to consolidate the Tier 1 and Tier 2 reserve products into one uniform, Synchronized Reserve product that is similar to Tier 2 today. This unified product will:

- Be obligated to respond based on the assigned quantity

- Be compensated at the applicable clearing price for the assigned MW amount

- Face the existing penalty if the resource does not respond during an event

The offer behavior will be modified to adequately capture parameters from the energy market and, to reflect an accurate maximum level of synchronized reserve offers required.

2. Improved utilization of existing capability for locational reserve needs

The current static reserve zone modeling approach (RTO reserve zone with MAD sub-zone) does not always accurately reflect the constraints dispatch is most concerned with in an overload condition. This can lead to either the loading of the constraints or a reserve price that is not aligned with the reliability value of relevant locational reserves. PJM is proposing a more flexible reserve sub-zone modeling that would keep the existing RTO reserve zone with a closed-loop sub-zone structure. This would allow flexibility to change the location of the sub-zone on a day-ahead basis with options to allow changes intra-day, on an as-needed basis.

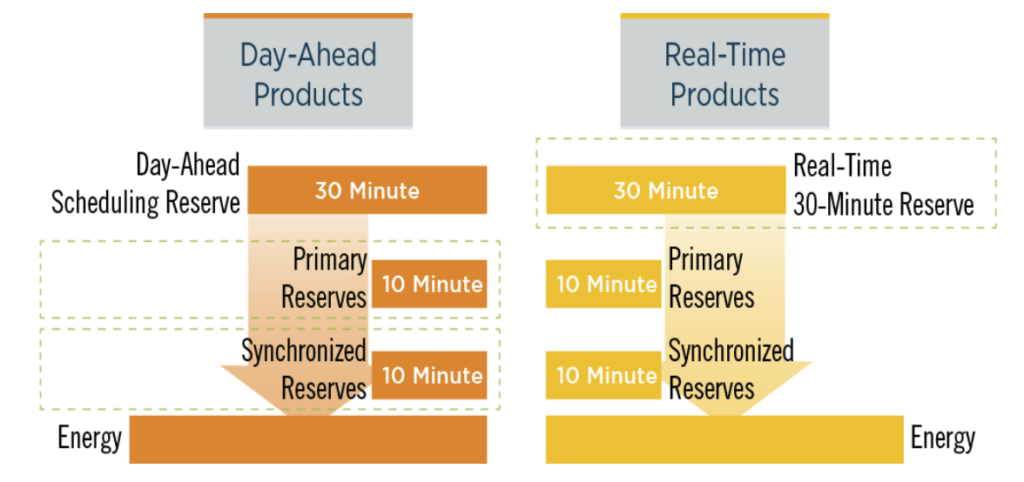

3. Alignment of market-based reserve products in Day-Ahead and Real-Time markets

In its current model, PJM operates a 30-minute reserve market, the Day-Ahead Scheduling Reserve Market (co-optimized with the DA Energy Market), and 10-minute reserve markets that are co-optimized with the RT Energy Market. This creates a modeling discrepancy between DA and RT, which has the following potential impacts:

- Scheduled supply to meet demand day-ahead (load + exports + reserves) does not match real-time

- Resources needed for reserves day-ahead may not match real-time

- Prices can be different

PJM is proposing an overhaul of the reserve market architecture to add 10-minute reserve markets to the DA market and a 30-minute reserve market to the RT market, as presented in the EPFSTF Meeting on December 14 of this year.

In addition to minimizing the modeling differences between DA and RT markets, PJM plans to implement identical Operating Reserve Demand Curves (ORDCs) in both for each of the 10 and 30-minute reserve products. PJM recognizes that in spite of identical ORDCs, economics in its DA and RT markets will ultimately determine the level of cleared reserves.

To ensure consumers do not pay twice for reserves, PJM plans to implement a full balancing settlement for all reserve products. In the same way, energy quantity deviations between DA and RT are settled at the real-time price, and reserve deviations between DA and RT are settled at the corresponding real-time reserve price.

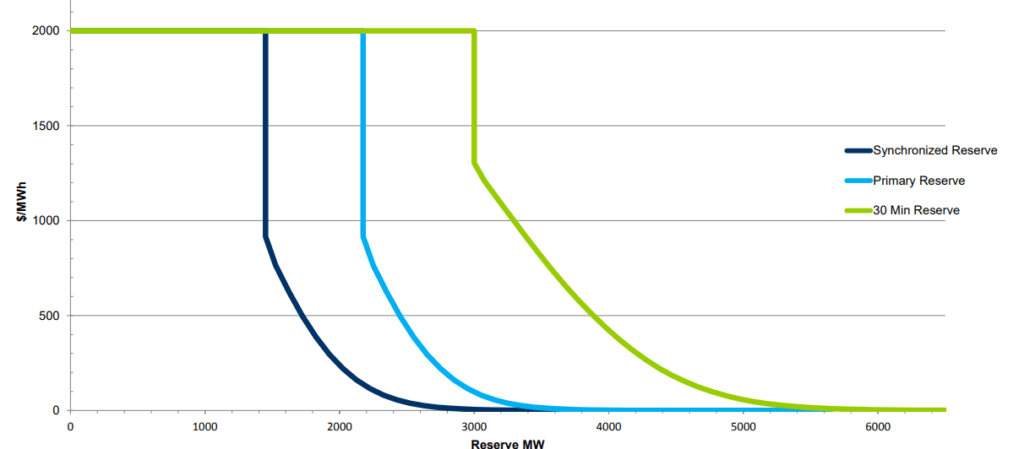

4. Operating Reserve Demand Curves (ORDC) for all reserve products

The current stepped Synchronized Reserve Demand Curve falls short of acquiring enough reserves to manage uncertainty and fails to accurately assign a value to reserves and energy. Therefore, PJM is proposing a downward-sloping ORDC to provide additional flexibility to the system beyond what the market models traditionally value. PJM is also raising the highest point on these demand curves from $850/MWh to $2,000/MWh. The revised ORDC incorporates the minimum reserve requirement in existence today but extends the current curve to include reserves greater than the minimum reserve requirement such that additional reserves are both scheduled and valued when it is rational to do so.

PJM believes that adopting the proposed methodology to construct ORDCs for synchronized and primary reserves will have the following benefits:

- Reserves in excess of the minimum reserve requirement will be appropriately valued based on their benefit to system reliability.

- PJM will assign additional reserves when economic to do so, which will result in fewer instances when (a) system operators take out-of-market actions to maintain reserves and (b) the minimum reserve requirement is not met and reliability is degraded.

- Reserve prices will be able to reflect all system operator actions taken to maintain reserves up to the $2,000/MWh penalty factor.

5. Increased penalty factors to ORDCs to ensure utilization of all supply prior to a reserve shortage.

The penalty factor acts as a cap on the cost to be incurred to satisfy the reserve requirement. A resource will not be committed for reserves if the cost exceeds the penalty factor. The penalty factor must be set high enough so that the shortage being signaled is due to running out of reserves rather than going short for economic reasons. The penalty factor should be revised to $2,000/MWh to allow these operator actions to be reflected in market pricing.

6. Transitional mechanism to the RPM Energy and Ancillary Services (E&AS) Revenue Offset to reflect expected changes in revenues in the determination of the Net Cost of New Entry

After PJM’s proposed price formation enhancements are approved, a historic Energy and Ancillary Services Offset will likely underestimate future Energy and Reserve Market revenues. PJM proposes to simulate the Energy and Reserve Market outcomes based on actual operating conditions but with the proposed reserve market modifications for Base Residual Auctions held after FERC approval is received.

PJM’s conclusions to date

PJM has run multiple simulations to study the impact of various design components on the overall Energy and Reserve Market. It has concluded that the proposed changes will:

- More accurately reflect operational needs in Energy and Reserve Market prices

- Reduce the need for operators to take price-skewing, out-of-market actions to maintain reserves by more accurately measuring the reserves on the system and procuring additional reserves (when economic to do so) in recognition of the uncertainties that operators must manage.

The more the market prices are able to capture the operation of the system and the value of all products, the better the market can function for all stakeholders.

Taken together, the package of changes represents a significant evolution to the reserve markets. PJM strongly believes that the best course of action is to pursue this comprehensive list of market reforms, which address the full set of reserve market issues in a holistic manner. After obtaining FERC approval, PJM is looking at a possible 12-18 month implementation timeline to fully revamp its reserve market.

PCI is tracking all PJM market changes closely

As always, PCI will be in attendance at relevant PJM meetings as stakeholders discuss the implementation details so that we are providing timely, value-added consultation services and software system changes to the GenManager bid-to-bill platform.