In the fall of 2001, I stood on a windy, deserted ridgeline in remote Pecos County, Texas, on a patch of land called Indian Mesa, where gigantic wind turbines were being lifted high in the air. It was during the construction of one of the first waves of wind farms in west Texas. The turbines had the words “ENRON WIND” prominently emblazoned on them, and once tested and certified, these turbines produced a total of 160.5 MW, sending the power out through a 69kV transmission line. However, there was an issue with energy storage from the turbines.

The wind in this area blows mostly at nighttime, so the transmission line, snaking its way through scrubland near Iraan, frequently strained to move all the power that Indian Mesa and other nearby farms were producing. As a result, ERCOT directed curtailment of this generation regularly. I remember at that time thinking that if only all that power could be piped into some massive batteries, it could be dispatched during the day when we really need it.

It’s taken 20 years, but large-scale energy storage is finally coming to the Texas power market. It will play a key role in enhancing the grid’s reliability and reducing the state’s use of fossil fuels for energy production. What is the magnitude of this storage revolution? How has the grid readied itself for the integration of all these resources?

Growth of renewable energy in the Texas power market

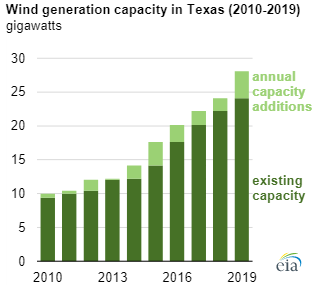

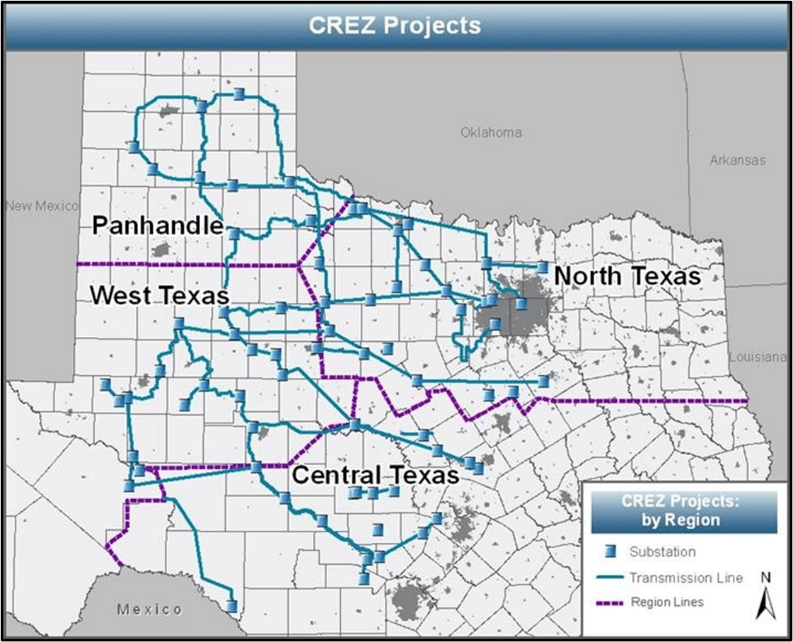

Indeed, the astonishing growth of renewable energy in Texas has been phenomenal. For many years, just the year-on-year growth in the Texas power market was more than the total capacity of whichever state was in second place. This growth didn’t come without issues, however. Most of the locations amenable to wind development were in the west and the panhandle, while the population and load are generally in central and east Texas. Curtailment of energy (like what was happening at Indian Mesa) was not a sustainable solution, so in the 2000s, a massive investment was made in additional transmission infrastructure to convey this abundant, clean energy from these “Competitive Renewable Energy Zones (CREZ)” to the load centers.

This process has been largely successful in bringing far more renewable energy to the Texas power market. For example, as of January 2021, over 25,000 MW of wind capacity was operational in ERCOT, representing 24.8% of ERCOT’s total generating capacity. Coupled with the 3,854 MW of solar (3.8% of the total), nearly 30% of the ERCOT electricity generation capacity is from clean but intermittent sources.

Bring in energy storage

To complement this significant investment in renewable energy and help meet the reliability needs of ERCOT, many investors have seen the value of constructing energy storage in this market. As of June 2021, already 250 MW of energy storage was in operation, with another 1 GW more on its way by 2022.

Looking further out, ERCOT is tracking over 27 GW of interconnection requests for battery energy storage co-located with solar. In addition, approximately 800 MWW are expected to be co-located with wind farms, 3.2 GW co-located with thermal resources, and 19 GW stand-alone projects. Granted, many of these may not ever be constructed, but it does demonstrate the intense investment interest present in the Lone Star State.

Wholesale market design evolution

To prepare for better managing this significant addition to its fleet, in 2019, ERCOT created the Battery Energy Task Force (BESTF) to identify key topics, concepts, and needed rule changes for the large-scale integration of energy storage resources into the market. In addition, new market rules, settlement methods, modeling approaches, and control software are needed to fully integrate this massive wave of new resources expected to enter the market.

The BESTF addressed key concepts in several areas: dispatch, pricing, and mitigation; performance criteria, options for maintaining the desired state of charge, settlement, DC-coupled resources; energy storage resources on the distribution system, and other topics.

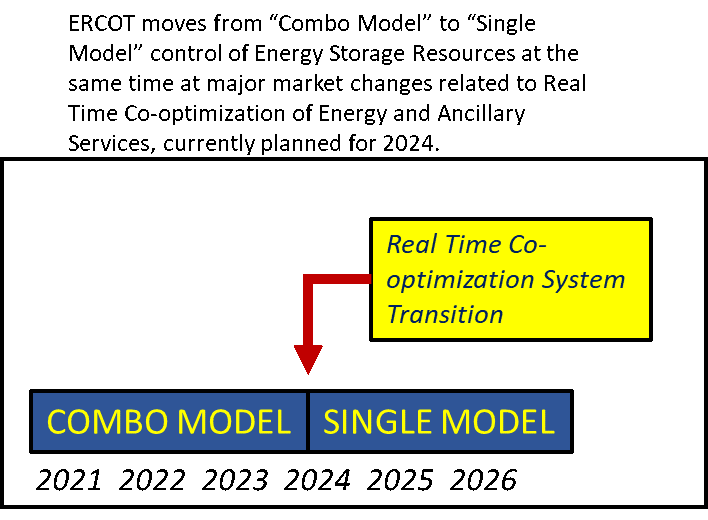

However, one of the first items was establishing that currently operating energy storage resources will be managed under the “combo model.” For example, under current protocols, when a battery is charging, it is operated like a Controllable Load Resource, but it will be dispatched like a generation resource when discharging. This scheme will continue until the “single model” approach is rolled out in conjunction with a major ERCOT market change addressing the co-optimization of energy and ancillary services, expected in 2024.

The “single model” approach will enable energy storage resources to offer the resource into the market both for charging and discharging. It will use a single offer curve, with negative-priced bid pairs for the charging portion of the curve and positive-priced bid pairs for the discharge part of the curve. Security Constrained Energy Dispatch will deploy the unit seamlessly across the offer curve, charging when prices are low and dispatching when prices are high. Operators can also reserve the unit (ONHOLD status) during any operational day so it doesn’t charge or discharge and update energy offer curves right up to the operating hour.

Other important attributes of the single model rules include:

- No time constraints on StartTime, MinUpTime, MinDownTime

- No Startup, Shutdown, or Transition costs will be included in the dispatch model

- Energy awards will be positive MW for discharge and negative MW for charging

- Ancillary Services awards will be positive MW

- QSEs will have the responsibility (at least initially) to maintain the State of Charge and reflect energy capacity to ERCOT through telemetry or the Current Operating Plan.

The large-scale integration of energy storage into the ERCOT market is in full swing. The electricity grid in the nation’s second-largest state has seen phenomenal changes since the day I squinted into the sun at the wind farm construction site and is about to undergo an even more complex transformation. More energy storage means more efficient use of the tremendous amounts of renewable energy being produced. It also means more resources are available to meet the peak in summer and respond to supply and demand swings that plague the grid during shoulder months. Of course, much more work is needed to complete the integration in rules development and grid operations, but the time is finally coming when the Texas power market can use more of that off-peak wind energy during the day when customers need it most.

Learn more about PCI’s Battery Optimization, Trading and Scheduling Solution.