Spend more than five minutes talking to anyone in the energy transmission industry, and you’ll hear the terms Independent System Operators (ISO) and Regional Transmission Organizations (RTO). While initially envisioned to be two pieces of the same puzzle, these acronyms have become interchangeable over time. Whether someone refers to an ISO, RTO, or even an ISO/RTO, they’re likely talking about the same thing — an organization that manages the high-voltage transmission grid in the U.S.

In this article, we’ll explore the history of these two groups and how the differences between them, at this point, are basically semantics.

ISO/RTO Documentation Chatbot

Use our AI to search Business Practice Manuals from ISO/RTO markets at no cost.

The birth of ISOs and RTOs

Before ISOs were formed, all aspects of a market’s grid electricity, from generation to transmission and distribution, were typically owned by a single entity. This lack of competition led to higher prices for energy buyers who had little choice in where they could purchase electricity.

In 1996, the Federal Energy Regulatory Commission (FERC) took action to increase competition in the electricity market and ensure there was no discrimination regarding transmission access. The result was FERC Order 888 and FERC Order 889, which established a series of Independent System Operators (ISOs).

In addition to changing market economics and improving access, ISOs were designed to reduce government oversight and ensure grid reliability. Essentially, these organizations run the high-voltage transmission grid for transmission owners in their respective regions.

In 1999, FERC issued Order 2000, encouraging smaller transmission entities to join Regional Transmission Organizations (RTOs) voluntarily. RTOs run the transmission grid on a regional basis across North America and Canada. The order included specific technical requirements an operator must meet to be considered a FERC-approved RTO.

Essentially, FERC envisioned RTOs as larger organizations composed of multiple independent ISOs. PJM, which serves the Mid-Atlantic states, is an example of an RTO. It was formed from power pools that were first organized in the 1920s.

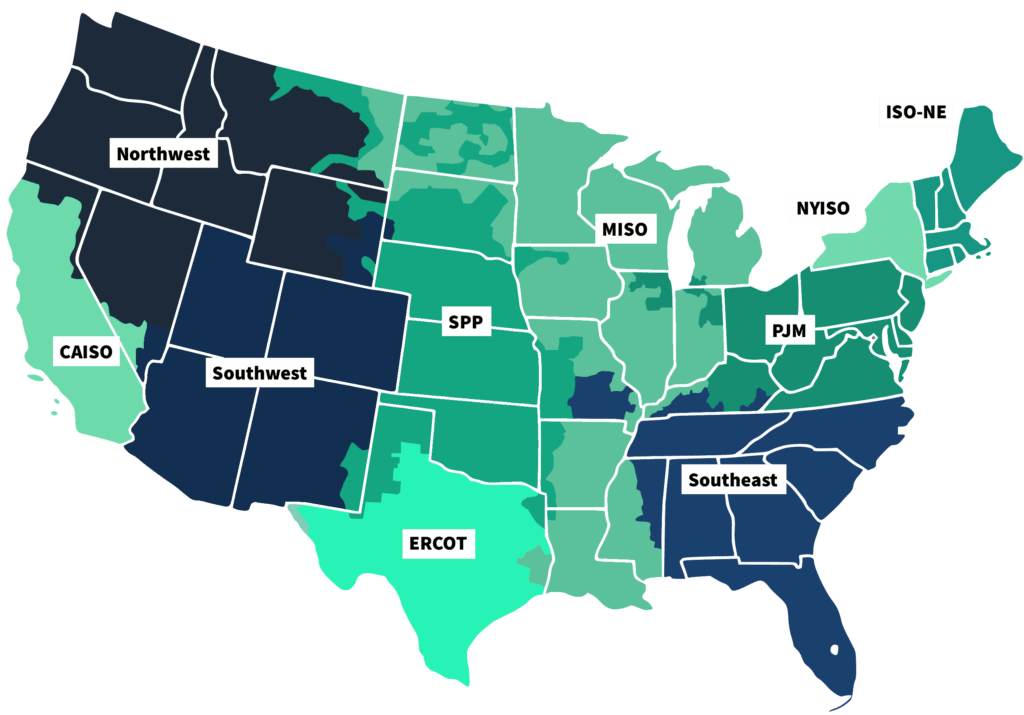

The regions

The U.S. is split into 10 distinct transmission regions, as shown in the above map. The Southeast, Southwest, and Northwest all have traditional wholesale electricity markets where utilities are responsible for grid operations and management as well as providing electricity to customers. For that reason, we’ll exclude them from this conversation.

The remaining seven are ISOs or RTOs (see map). ISOs include the California ISO (CAISO), the Midcontinent Independent System Operator (MISO), the New York Independent System Operator (NYISO), and ISO New England (ISO-NE). The Electric Reliability Council of Texas (ERCOT) is also an ISO, though it does not fall under the purview of FERC. The Southwest Power Pool (SPP) and PJM have RTO status.

All told, two-thirds of the U.S. electricity load is served in ISO and RTO regions, according to FERC.

What's the difference between an ISO and RTO?

When discussing an ISO vs. RTO, we start getting into the semantics. Both ISOs and RTOs share the same general mandates:

- They must operate as a nonprofit

- They must ensure non-discriminatory access to the transmission grid by both customers and suppliers.

- They operate the bulk power transmission system within their footprint and do so independently of the wholesale market (meaning they don’t sell electricity to end users)

- They cannot own any equipment (generators, power lines, and the like)

- They must obtain electricity from generation suppliers to maintain system reliability and meet market demand

The only difference between an ISO and an RTO in today’s market is the size of its footprint and the way it prices services. Because each ISO and RTO operates independently, each sets prices based on specific supply and capacity tags. Other than that, the two organizations serve the same purpose — no matter what they’re called.

Optimize your energy portfolio

Navigating the complexities of ISOs and RTOs requires robust tools and strategies. Discover how PCI’s Portfolio Optimization solutions can help you maximize profitability and efficiency within these regions.