Let me start with a confession: I tried to retire. It didn’t stick.

When the opportunity came up to help launch Alpha Generation and build a company around two dozen thermal power plants, I jumped back in. My first move? I got in my car and drove across the U.S. visiting plants. I sat down in our control rooms with Plant Managers, had coffee, and listened. Because at the end of the day, this job is about people and power. It’s about building something that is resilient and reliable.

Flying into New York on one of those early visits, I snapped a photo from the plane window. Everyone else was probably admiring the New York City skyline. Not me. My gaze focused on the power infrastructure and zeroed in on one of our power plants in Kearny, New Jersey, a stone’s throw from Newark airport. That site has been generating electricity for over a century. While touring the plant, I was charmed by a picture outside the Control Room. The black and white picture showed Thomas Edison at the plant’s commissioning in 1925. Back in Thomas’ time the site burned coal to produce electricity, the plant was transitioned to oil in the 1950s, to natural gas in the 1980s, and now is home to ten LM6000 peaking combustion turbines.

Standing where Edison once stood, it hit me: energy transition takes a long time. It’s generational. While other industries like telecom have evolved quickly – from rotary phones and copper wires to smartphones and cell towers in a few decades, the energy industry has been transitioning at a slower pace, deliberately, and with good reasons. Physics and high stakes.

What’s behind the hockey stick?

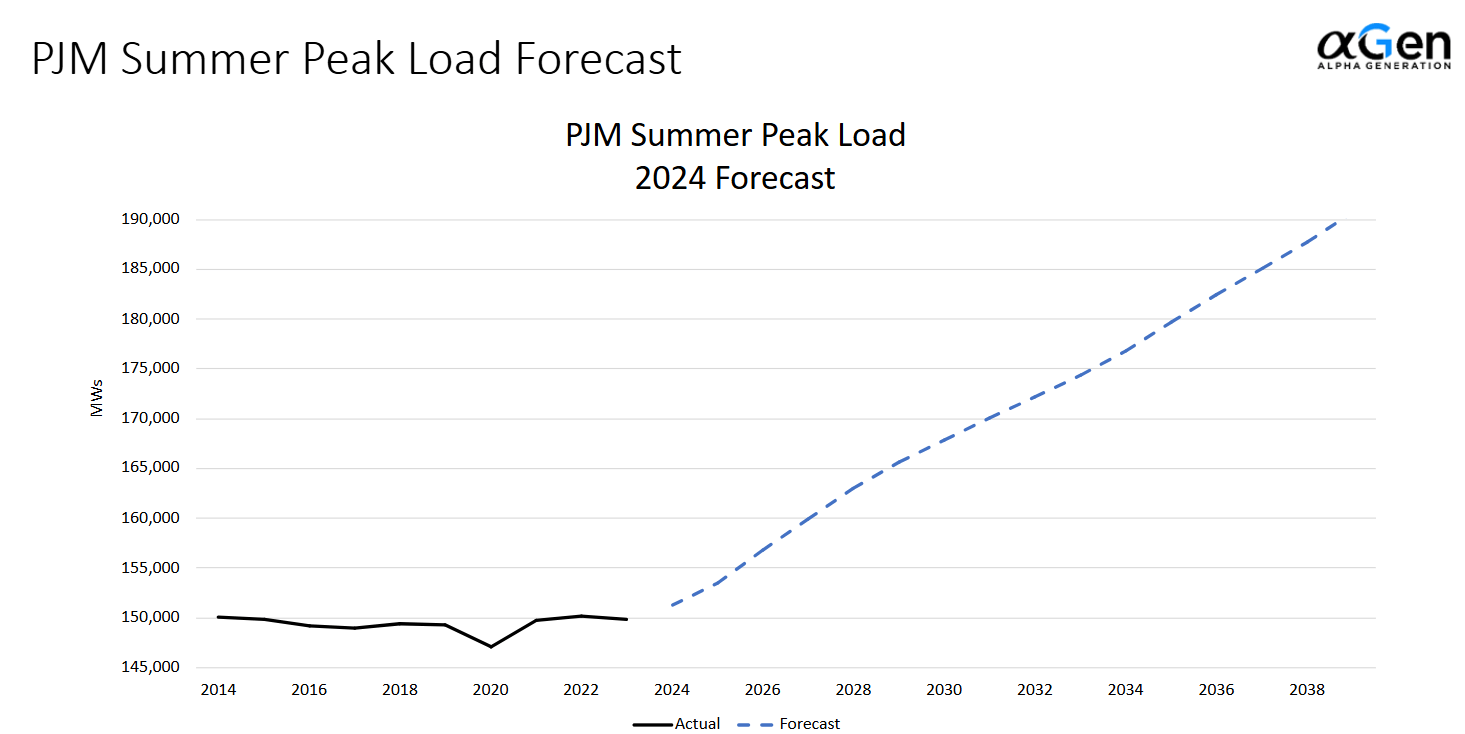

So, let’s talk about demand. You have probably seen the shocking PJM summer load forecast — the black line showing actual peak demand for the last decade and a blue dashed line for the forecast, a classic hockey stick.

I ponder that chart and think, really? Are we sure? We are at an interesting juncture for the energy industry. We are talking about the electrification of economy, reshoring our manufacturing capabilities, the future of AI, adoption of EVs, converting to electric home heating — it all gets rolled up into this projection.

The EIA (Energy Information Administration) breaks down historical and projected U.S. energy consumption by sector. Residential and commercial consumption is ticking upward. Industrial consumption of power is also forecasted to rise. But what is driving this surge and how confident are we that it will materialize?

The AI arms race and Data Center Alley

Enter data centers. PJM is forecasting data center power consumption will increase from 5,000 MW in 2024 to 35,000 MW by 2039 primarily located in and around northern Virginia’s Data Center Alley. AI forecasted demand is driving the forecast — these systems are power hungry, consuming 10x the electricity of a traditional Google search.

Many politicians see this as a national security issue. If we don’t build the AI infrastructure here, other nations will. States like Texas, Pennsylvania, and Ohio are racing to attract new data centers. But it’s not just a matter of building; it’s a matter of grid readiness.

Three regions, three big bets

PJM might be bullish, but what about other large power grids? The New York ISO shows similar load growth, driven by electric vehicles. New England’s forecast is even steeper — and no, they’re not betting on data centers. They’re forecasting a conversion of home heating from oil and natural gas to electricity.

If all three are wrong? That’s a big miss. If they’re right? We need to get ready.

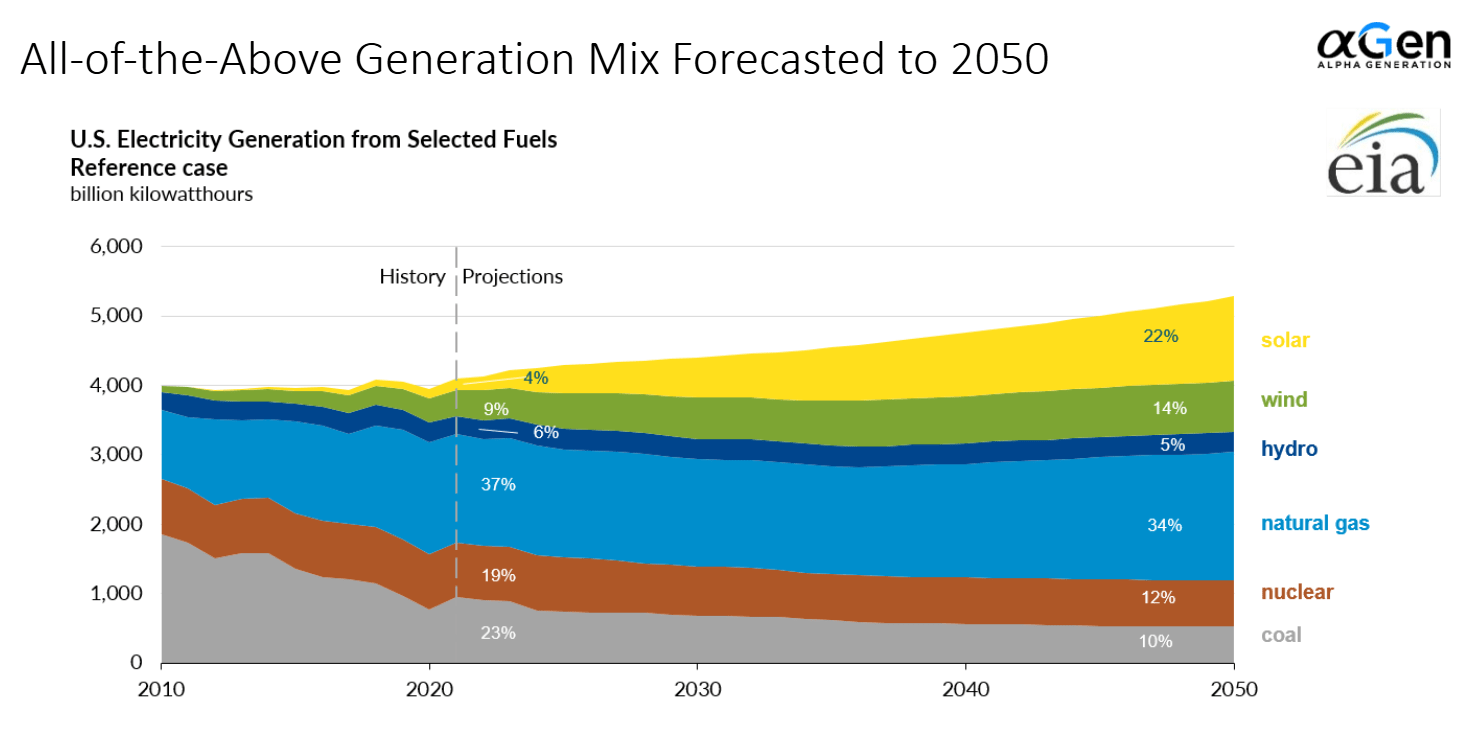

An “all of the above” generation strategy

So how does the industry meet that kind of demand? The EIA projects that while coal’s share of the generation stack will continue to decline, and nuclear will stagnate, that we will continue to rely on dispatchable natural gas plants to balance supply and demand.

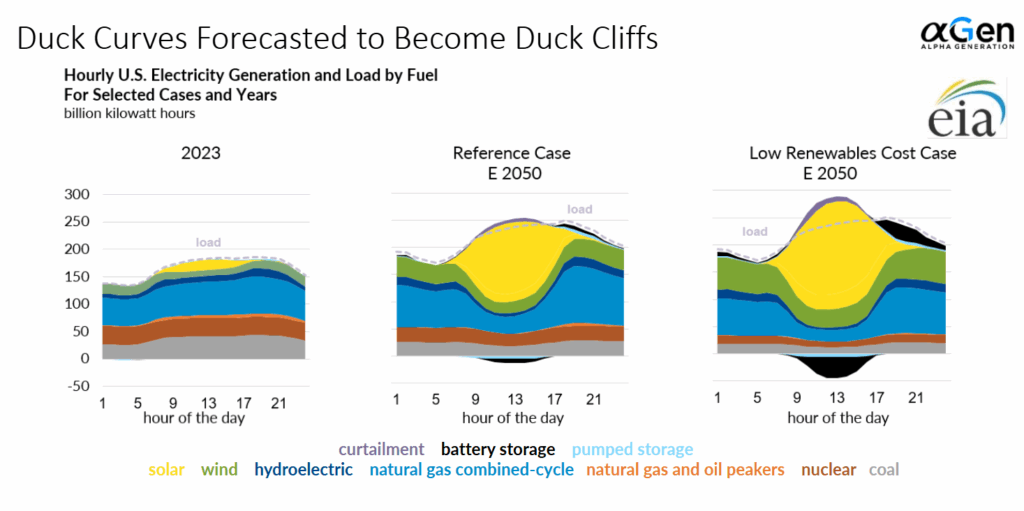

With the continued growth and addition of intermittent resources, the grid will face real challenges. Enter the “duck curve” – a dramatic ramp in solar generation midday and a steep drop-off as the sun sets. Managing this ramp requires dispatchable generation as well as massive battery deployments.

Texas has become a case study. We build fast here, but that rapid deployment has created volatility. We need smart pricing models and additional market mechanisms that match the dynamic needs for the grid of the future.

Grid reliability is now national security

For the last decade, the power industry was very focused on sustainability. In the last few years, it has pivoted to reliability. And not just for our comfort. Our world is more and more dependent on a robust, reliable power grid. Water, sewer, telecommunications, healthcare; we have put all of our eggs in the electric basket. We’re at a tipping point, with great power comes great responsibility. Literally.

Why PCI matters to Alpha Gen’s future

Data is exploding. When I started my career in 2001, Texas had 3 power zones and prices that changed every 15 minutes, roughly 105,000 power prices a year that needed to be managed; we did it on spreadsheets. Given the more complex nodal market in Texas, the number of power prices to track has skyrocketed to over 26 million. You can’t run that on a spreadsheet.

Our Alpha Gen team is implementing PCI as our ETRM and ISO interface. It’s the #1 project on our to do list for 2025. The system will help us manage risk, monitor outages, see positions clearly, and make smarter decisions — in day-ahead, real-time, and in long-term markets. This is the hard stuff. If it were easy, anyone could do it. But with the right partners and tools, we can meet the challenge.

A final word from ChatGPT (yes, really)

Lately I’ve been trying to exercise my AI muscles. So, while preparing for this speech, I asked ChatGPT: Why is electricity so critical to modern society?

She said: “Electricity is the backbone of nearly everything we do.” And she’s right. From comfort and convenience to economic output and public safety, electricity powers our lives.

My job — our job — is to make sure it stays that way.

Interested in learning more about Alpha Generation? Visit alphagen.com.