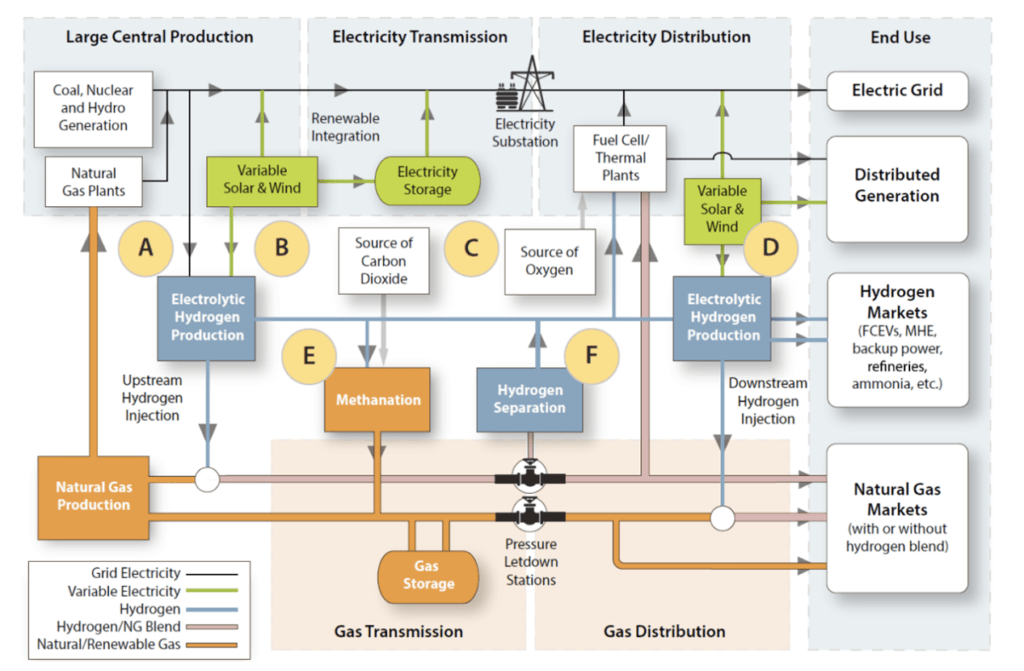

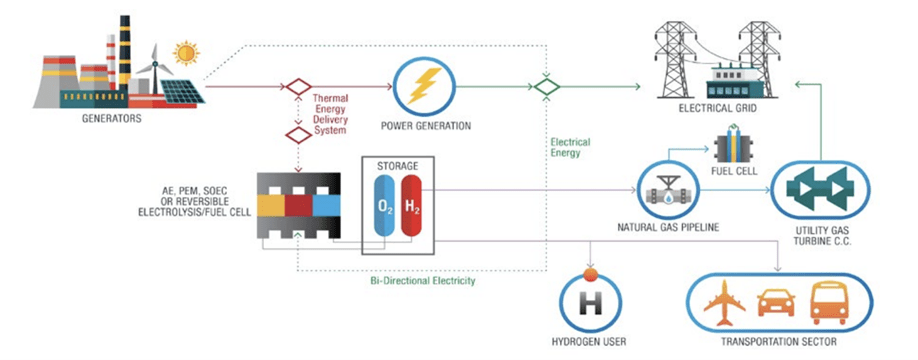

In the previous blog post in our hydrogen series, “Hydrogen Power 101,” we looked at how an electrolyzer produces green hydrogen using excess renewable power to separate hydrogen from oxygen molecules in water. Electrolyzers are paired with storage technologies – tanks, pipelines, and salt caverns – that function like batteries that charge up with cheap power and provide regulation and load-following grid services. This dynamic modeling and validation of electrolyzers in real-time grid simulation demonstrates early progress and identifies potential gains in future performance. The stored hydrogen is then available for transport for use in power-generating technologies like fuel cells and combined-cycle gas turbines.

This follow-up blog post will consummate the battery analogy by considering electricity production, storage, and generation in various hydrogen use cases.

Long Duration Storage

Hydrogen’s storage potential far exceeds the capacity and duration of any utility-scale battery. Electrolyzers can produce hundreds of GWh of potential electricity to store for long durations to help levelize seasonal wind and solar energy volatility. Using underground salt caverns is critical to achieving the scale necessary to form a fully functioning hydrogen market. The ACES project’s two salt caverns will hold more than 5,500 metric tons of hydrogen, each holding the equivalent of 150 gigawatt-hours (GWh) of carbon-free dispatchable energy. ACES is currently under construction and is projected to come online in 2025. Using salt caverns for energy storage supports the increased build-out of renewable energy and a fixed price for hydrogen production and storage.

Another significant use case for salt cavern storage is being developed for the Mississippi Clean Hydrogen Hub, which is designed to produce 110,000 metric tons of green hydrogen and 70,000 metric tons of storage. Pending regulatory approvals and equipment availability, the hub’s first phase is projected to enter commercial service by 2025. Hydrogen City, Texas, will be an integrated green hydrogen production, storage, and transport hub growing to 60GW in size and producing over 2.5 million metric tons per year. The project will be built in phases, with the first phase expected to commence operations in 2026 and consisting of 2GW of production and two storage caverns at the Piedras Pintas salt dome in Duval County. Eventually, over 50 caverns can be created at the project site, providing up to 6 terawatt-hours (TWh) of energy storage and turning the dome into a major green hydrogen storage hub, like Henry Hub’s role in the natural gas market.

The uses for hydrogen span multiple sectors and industries. It’s used heavily in steelmaking, as a critical component in fertilizers for agriculture, as a gasoline and diesel alternative for transportation, and off-grid auxiliary as well as utility-scale grid power generation.

Hydrogen is often lauded as the “Swiss Army knife” of “sector coupling,” where a few strategically placed production hubs generate hydrogen to be used for many downstream applications. Governments and industry leaders worldwide are pouring money into research and experimentation to find the most practical, efficient, and cost-effective ways to compress, package, and transport hydrogen for all those applications.

Necessity is the mother of invention. The urgency surrounding climate change, energy security concerns, and skyrocketing natural gas prices since the middle of 2021 have turbocharged political backing and interest in renewables-based hydrogen production in Europe and fast-tracked implementations around the globe. Although the U.S. may not be as impacted as Europe by energy supply concerns, a sense of urgency moves us toward imminent breakthroughs in the hydrogen economy. In the last few weeks, we’ve seen further advances in the ACES project, new feasibility studies for blending hydrogen in natural gas pipelines, and GW-scale electrolyzers announced in Texas, just to name a few.

If you think long-duration hydrogen storage in salt caverns is much like storing natural gas, you’re on the right track, but there are a few glaring differences. Obviously, unlike natural gas, green hydrogen is carbon-free. But another significant difference is the fact it’s made locally and diversifies the portfolio away from price volatility and supply disruptions inherent in fossil fuels. Consider the 2021 ERCOT winter power crisis, when power supplies fell short due to a lack of wind generation and natural gas availability. A cavern or two full of hydrogen, combined with re-electrification hardware, would have lessened the blow.

Hydrogen Re-Electrification

Electrolyzers are half the equation. The round-trip is complete when we convert the hydrogen back into electricity. There’s a myriad of uses (i.e., revenue streams) for hydrogen, but I’ll focus on two common methods for grid power production: fuel cells and the combined cycle gas turbine (CCGT).

Fuel Cells

Fuel cells combine hydrogen and oxygen to generate electricity in a chemical reaction. The only byproducts are heat and water vapor, and unlike burning hydrocarbons, the process does not emit carbon dioxide or other noxious emissions. Fuel cells have been around for over a century but have only recently grown near utility scale. These are still relatively small – the world’s largest fuel cell power plant is rated at 50 MW. The conversion sequence of power to gas to power (P2G2P) is currently cost-prohibitive for two separate production systems and will rarely be viable from a system design perspective.

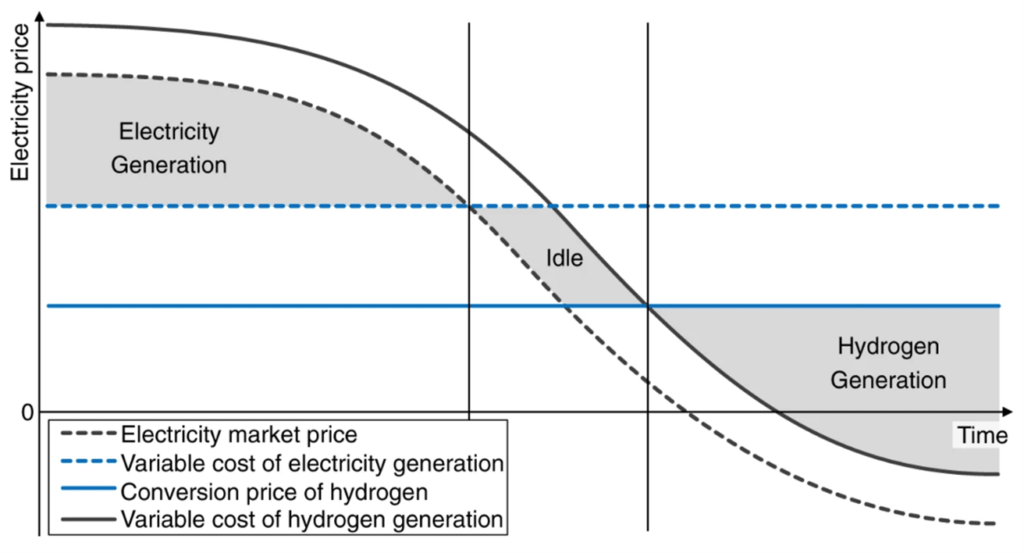

In contrast, unitized regenerative fuel cells are bidirectional and designed to operate in reverse in an integrated power-to-gas (P2G) system that uses the same equipment to deliver hydrogen or electricity based on the prevailing supply and pricing environment. Reversible P2G systems have been modeled for both German and Texas markets and demonstrated current cost-competitiveness, as shown below. Notably, these models were built before the current energy supply, and extreme heat crises created commodity chaos and market turmoil of unknown duration.

Contribution margins of a reversible power-to-gas system:

Link to Creative Commons License: https://creativecommons.org/licenses/by/4.0/

Combined Cycle Gas Turbines

At present, the most viable large-scale hydrogen electricity producer is the familiar aeroderivative combined cycle gas turbine (CCGT). Blending hydrogen with natural gas reduces both natural gas consumption and the carbon footprint. There are numerous projects underway blending various ratios of hydrogen to natural gas. Companies like Mitsubishi Power already have commercially operating plants that support up to 30% hydrogen, with the goal of supporting 100% hydrogen by 2025.

Solutions like this provide a viable bridge to the hydrogen future since investments in the capacity needed to meet today’s needs will not become stranded assets under the 2050 Net Zero pledge.

This conversation is building momentum in the industry. To further this interesting conversation, PCI invites you to join our webinar to learn how utilities and power producers can economically produce and use hydrogen for wholesale power generation using:

- Renewable power electrolysis

- Fuel cell technologies and pricing models

- Combined-cycle gas turbines with hydrogen blending

We’ve hosted an educational webinar, “Hydrogen Power: Opportunities & Challenges.” If you missed it, request the slides! If you’re interested in what PCI can do for you, check out our hydrogen solution.