The expansion of utility-scale battery storage in the U.S. is making headlines. Since 2021, battery storage U.S. capacity has seen a steady increase in its battery storage capacity, and if the current pace continues, the Energy Information Administration (EIA) expects battery storage to set a record for annual capacity by nearly doubling in 2024. This would push U.S. battery storage capacity over the 30 gigawatts (GW) mark.

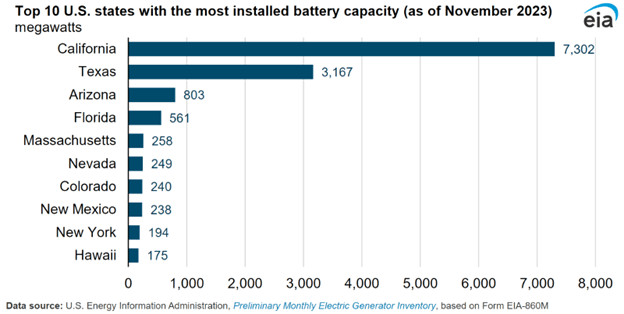

This surge in U.S. battery storage is largely credited to two states: California and Texas. California leads the nation with 7.3 GW of installed utility-scale battery storage, followed by Texas with 3.2 GW. More than 300 utility-scale battery storage projects are expected to come online by 2025, with Texas hosting about 50% of the new battery storage capacity. Battery storage capacity in Texas alone exceeds that of the next eight largest contributors combined.

The surge in U.S. utility-scale battery storage is driving a grid transformation. As states rapidly adopt these energy resources, overcoming technical challenges and optimizing battery operations will be critical. This article explores the key hurdles introduced by battery storage integration and the software capabilities needed to master utility-scale battery management.

Technical challenges of utility-scale battery integration

Managing the new grid presents both technical and business challenges. As the U.S. energy sector leans increasingly on renewable sources, the role of battery storage becomes crucial. It not only supports the integration of solar and wind energy into the grid but also ensures reliability and sustainability in the power supply. A significant technical challenge is the reduced presence of Volt-Amperes Reactive (VARs) and inertia — characteristics of synchronous generators that have been the backbone of electricity grids for over a century. These generators provided essential services to the grid, such as frequency and voltage regulation, through their mass and rotational inertia. Conversely, batteries and renewable energy sources lack mass and rotation — they are inverter-based resources (IBRs). Grid-Forming IBRs operate with significantly less inertia but have an impressive ability to respond to grid demands at a much quicker rate. This rapid response capability of IBRs can reduce the overall amount of inertia the grid has historically relied on.

Managing battery storage at scale

There are many political and business challenges as well, ranging from supply chain, permitting and transmission bottlenecks to the increased complexity of managing a larger number of small resources. Gone are the days of offering a few large coal units and combined cycles that comprised a huge portion of the capacity, adding to the workload of traders and portfolio managers.

Key software for battery storage management

Managing a larger, more splintered portfolio requires sophisticated software with the ability to automate repetitive tasks such as optimizing and submitting offers to the market. Machine learning and massive compute power have fortunately evolved alongside the changing grid. Sure, this has expanded data centers and increased load, but overall, they help more than harm by controlling the system much more efficiently. Highly intelligent and fully automated trading systems are becoming essential to the energy transition. For a renewable portfolio manager or trader, here are some key features that can dramatically improve your profitability:

- Machine-learning price and renewable energy forecasts

- Sub-hourly data feeds showing current and forecast battery state of charge (SOC)

- Models that run automatically to refresh your operational and financial predictions when input data changes, such as price, wind or solar forecasts, outages, and derates

- Stress testing bid and offer strategies to better understand risks and returns in the day-ahead, real-time and ancillary services markets

- Automated after-the-fact analysis to continuously learn and improve your market engagement

The PCI Solution for U.S. battery storage capacity growth

PCI Energy Solutions is at the forefront of this revolution, offering cutting-edge software tailored for renewable portfolio managers and traders. Our new BatteryTrader platform features machine-learning algorithms for accurate price and renewable energy forecasting, along with sub-hourly data feeds for battery SOC monitoring. Our models run autonomously, refreshing your operational and financial projections with critical input, from weather changes to market shifts.

Moreover, our software’s ability to stress-test bidding strategies and automate post analysis across various markets ensures you’re prepared for any scenario, optimizing risk and returns.

PCI Energy Solutions is ready to help your organization transform complexity into profitability with software designed to meet the challenges of the energy transition.