FERC Order 825 is gradually becoming a reality across energy markets, and soon it will significantly impact many areas of your trading business, including energy accounting and settlements, as well as data warehousing and reporting. In this post, PCI will examine each of these and highlight a few opportunities to benefit from the increased data granularity of 5-minute settlements that will soon be implemented in MISO and PJM.

Energy-Accounting and MDMA Functions

There are numerous potential benefits as well as costs to consider in submitting 5-minute data, and individual market participants will need to decide whether to submit the more granular revenue quality meter data or continue submitting hourly values.

What are the costs of submitting 5-minute meter data (Revenue-Quality Data) for resources?

IT infrastructure upgrades could be required to support additional data requirements associated with a 5-minute data submission. For example, you may need to:

- Upgrade your metering system to support 5-minute granularity

- Submit and validate 5-minute meter data for selected generators

- Modify data interfaces to import 5-minute intervals

- Support a 12x increase in meter data volume

- Possibly upgrade your Energy Accounting software

What are the benefits of submitting 5-minute meters (revenue-quality) for resources?

In short, more accurate settlements, particularly for resources with loadings that fluctuate a lot in real-time (such as wind farms, hydro plants, and combined-cycle resources). For fast-moving resources, using 5-minute revenue-quality meter data is recommended because it can increase real-time payments and decrease penalties for generators.

For nuclear or coal units, using 5-minute revenue-quality meter data may not have a big impact, so you can probably justify staying with hourly meter data for these stable and slow-moving baseload resources.

Note that, in continuing with hourly revenue-quality meter data for generators, the RTO will use either flat or telemetry profiling using the 5-minute state-estimator values to derive 5-minute meter data.

How Does the Telemetry-Profiling Method Work?

If you submit hourly meter data, RTOs will use either a telemetry profiling method or a flat-profiling method to convert hourly meter data into 5-mn meter data for settlement calculations. Flat profiling simply repeats the MDMA value 12x for each interval. Telemetry profiling shapes and scales the MDMA across 12 intervals using the MDMA value and TELVOL.

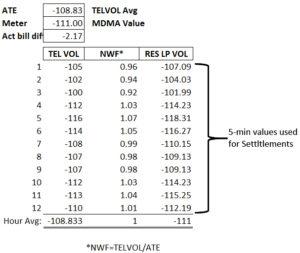

Below is a numerical example to show a typical 5-minute Profile Calculation, which creates 5-minute data by scaling the Telemetry Volume shape to the submitted hourly MDMA value using the Normalized Weighting Factor (NWF).

Terminology used in the example above:

- Hourly Meter Data (MDMA): Hourly data submitted by participant (Revenue-Quality Meter Data)

- TELVOL (Telemetry Vol): 5-mn meters obtained from RTO state estimator (reflect SCADA quality)

- RES LP VOL: 5-mn meter data that will be generated by RTO and used for RT settlement

- Normalized Weighting Factor (NWF): Ratio of 5-min TELVOL to the average hourly TELVOL used to scale the submitted MDMA meter.

This graph shows the TEL VOL and calculated RES LP VOL for 12 5-min intervals

Click here for additional details pertaining to MISO.

Settlement Validation

Settlement validation and P&L calculations are also significantly impacted by switching to 5-minute meter data. Changes will need to be made to perform shadow calculations and accommodate the larger data set. Some changes include:

- 10-40 real-time charge codes (depending on the ISO) change from hourly to 5-minute granularity. For example:

- RT make-whole payment calculations

- Excessive/deficient energy

- 12x increase in settlement data volume for affected billing determinants and charge codes

- Need to upgrade IT infrastructure to perform shadow and validate RTO settlements with increased granularity

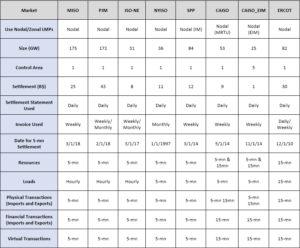

The following table shows 5-minute granularity under FERC 825 by ISO:

Data Warehouse, Business Intelligence, and P&L Reporting

Data Warehouse and Business Intelligence to support back-office reporting will also see a big impact from FERC 825 because of the increased data volume but also due to table and dimension changes needed to support the new granularity. As PCI blogged recently, DART P&L for fast-moving resources can potentially increase by 5-30 % under the new rules.

Key Takeaways

To comply with FERC Order 825, RTOs will need to line up settlement and dispatch intervals in the RT market. To meet this goal, RTOs will need to:

- Allow resources to submit meter data on a 5-minute, 15-minute, or hourly basis

- Use a profiling method (telemetry or flat) to generate 5-minute meter data for resources that submit hourly meter data

- Settle RT credits or charges for resources on a 5-minute basis

- Settle RT credits or charges for loads on a 5-minute or hourly basis

For market participants, the implementation of 5-minute settlements means:

- IT infrastructure upgrades

- Business Intelligence and reporting enhancements

- RT credits for energy and ancillary services may increase for fast-moving resources

- RT make-whole payments may decrease

- RT RUC charges may decrease

- RT load, admin, distribution, and uplift charges will stay roughly the same

PCI is currently helping several market participants to better position themselves in order to benefit from these significant market changes. Please contact us if your organization requires similar guidance during this transition.