The ISO New England Forward Capacity Market (FCM) “Pay-for-Performance” initiative is changing the shortage event penalty structure to a new two-settlement design. This change is set to go live on June 1 of this year and will create financial incentives for all capacity suppliers, irrespective of their participation in the FCM, which will help maximize availability during scarcity conditions.

Understanding Capacity Scarcity Events

A capacity scarcity event is the one that triggers performance payments and charges for capacity.

When the system is deficient, the ISO redispatches resources out of merit to create reserves, thereby driving the real-time reserve price above zero. When the ISO cannot redispatch supply anymore, the real-time reserve price is set at the Reserve Constraint Penalty Factor (RCPF), is included in the 5-minute LMP, and a Capacity Scarcity Condition occurs during that 5-minute interval. This could be a deficiency meeting either the 10-minute Reserve Requirement, the Minimum Total Reserve Requirement, or the Zonal Reserve Requirement.

Each resource that provides capacity during a scarcity event receives a capacity performance score that could either be positive or negative. The payments /charges are based on this score and the fixed tariff rate (“Performance Payment Rate”).

How is a Resource’s Performance Score Calculated?

- Score = Actual Capacity Provided (MW) – (Balancing Ratio (MW) x CSO(MW))

- Actual capacity provided: Sum of resource output (MW) and reserve designation during scarcity (varies by resource type)

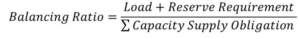

- Balancing ratio: The ratio representing required capacity and capacity supply obligation during scarcity conditions. Each Capacity zone has a balancing ratio when impacted by a scarcity event, which typically ranges from 0 to 1.

If a resource has no capacity supply obligation, then it is compensated for the actual capacity provided.

“Pay-for-Performance”

Here are some important details to understand regarding the FCM Pay-for-Performance initiative:

- Pay-for-performance replaces the current FCM availability metrics with a capacity performance metric based on energy and reserve delivery:

- It rewards good performers and penalizes poor performers during a capacity scarcity event

- There is a stop-loss mechanism for frequent bad performers

- It caps a resource’s performance at its Desired Dispatch Point (DDP) when the resource is subject to a transmission constraint to avoid establishing incentives for over-performance

- Pay-for-performance allows capacity scarcity conditions to occur within any capacity zone

- It introduces capacity performance bilateral transactions

- Pay-for-performance is (overall) revenue-neutral for the ISO

- During deficiency, if there are more under-performers than over-performers meaning total charges exceed total credits, the over-collection of funds is returned to suppliers (pro-rata) to their Capacity Supply Obligation at the end of the month.

- If a stop-loss mechanism is triggered, limiting losses and total funds collected are not enough to compensate the over-performers, the under-collection of funds is charged to all suppliers with a capacity supply obligation (pro-rata) to their CSO at the end of the month.

FCM Bilateral Transactions

The FCM Pay-for-Performance initiative provides a hedging mechanism by way of a capacity performance score Internal Bilateral-type transaction. It replaces the supplemental availability designations contracts and provides the ability to sell scarcity condition performance megawatts to resources impacted by the same scarcity condition.

Important Timeline & Milestones

- Pay-for-Performance implementation is scheduled to be effective June 1, 2018

- The first FCM settlement to contain new calculations is the Hourly and Non-Hourly services Bill for June 1, 2018 (issued July 16, 2018)

- Preliminary performance scores will be calculated and released to participants 5 -7 business days after each scarcity condition

- April 2018 – Sandbox environment available for new FCM Bilateral transactions.

PCI Supports the ISO-NE Bid-to-Bill Workflow

PCI’s GenManager platform will support the download and processing of the new MIS reports as well as the changed FCM settlement MIS reports going live in June 2018. More details about the impacted reports can be found on the ISO-NE notification.

PCI closely tracks all market changes to ensure updates to the MIS reports and SMD applications are incorporated in our GenManager System to ensure that all the functionality in the new market initiative is made available to PCI clients. Our development team will continue to post updates here on PCI’s blog (in addition to alerting clients directly via email). Please feel free to bookmark the blog site and /or click on the RSS icon at the bottom right of any blog page to copy it to your news feed. This will allow you to automatically be alerted when new posts become available.