Today, utilities that serve load are faced with a multitude of risks in the wholesale market. Prices can be high and volatile, and forecasts are often inaccurate. Having the right tools and resources is essential to successfully managing risks, covering costs, and taking advantage of opportunities.

Read on to learn how a Demand Response and Distributed Energy Resources portfolio can play a key role in these activities.

How Do Utilities That Serve Load Hedge Their Obligations?

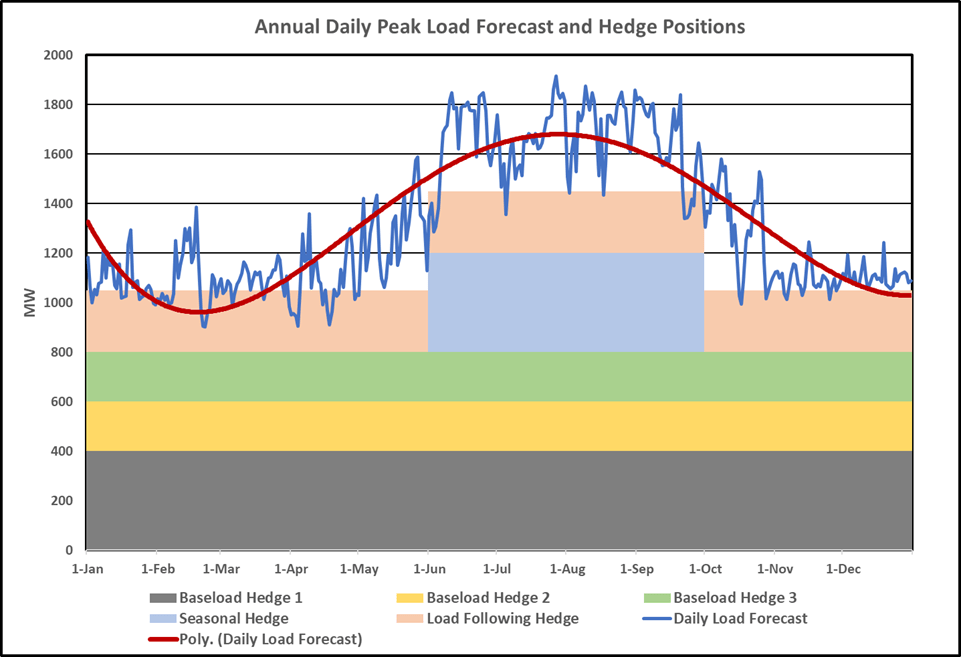

In many electric markets, utilities that serve load can manage the risks around that load by hedging out this obligation into the future at known prices. These “hedges” are purchases of power across different schedules and time frames to match the utility’s load requirements as closely as possible.

Figure 1. This utility has produced a daily load forecast based on historical data. A 4th-order polynomial curve is fit to the data to help visualize the annual pattern. Three baseload hedges and one seasonal hedge are in place to offset the majority of the utility’s load. A Load Following hedge is in place to supply 10% of the utility’s metered load, up to 200 MW, on a daily basis. This still leaves some “uncovered obligation” on certain days.

On any given operating day, however, the purchases previously made by the utility may not match up with the actual load forecast. In this case, the utility must purchase wholesale power from the market. For this purpose, most wholesale electric markets operate both a Day-Ahead Market (DAM) and a Real-Time Market (RTM). Each of these markets serves different purchases, but they do present price risks to the utility. A portfolio of Demand Response (DR) and Distributed Energy Resources (DER) can mitigate these risks if used wisely.

(For purposes of this discussion, DR refers to loads that can be reduced based on a signal from the utility. DERs are distribution assets – in front and behind the meter— that can produce energy for the utility at its command. These could be backup generators, energy storage, and other assets on the distribution system and under the utility’s control.)

How Does This Activity Play Out in Operation?

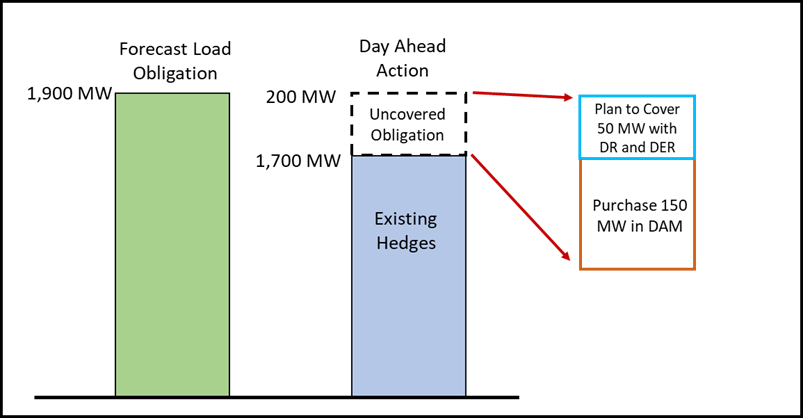

Let’s suppose a utility’s load forecast for tomorrow’s peak hour is 1,900 MW, 200 MW higher than what will be supplied by its purchased power agreements. This situation is a “short position” or an “uncovered obligation,” so to speak. If the utility moves into Real-Time without doing anything, it will buy enough energy to meet this shortfall in the RTM at Real-Time prices. This condition presents a risk because the RTM can be extremely volatile and expensive, depending on system conditions.

To mitigate some of this risk, the utility can purchase this 200 MW in the DAM, in which willing buyers and sellers can submit bids and offers in a central auction. The auction clears before real-time, securing quantities of power for the buyers at known prices and firm sales for sellers at known prices. This mitigation removes uncertainty related to the RTM regarding prices, though it cannot guarantee low prices.

How Can DR and DER Help Mitigate DAM/RTM Risks?

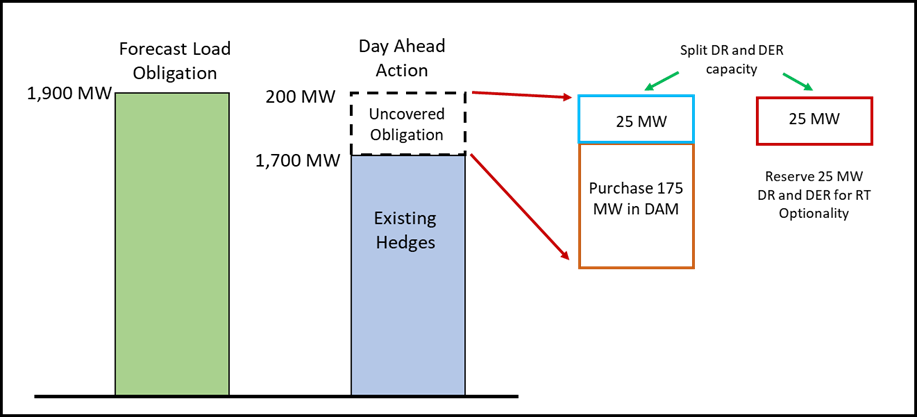

Let’s extend the above example and suppose this same utility, which is short 200 MW for tomorrow’s peak hour, has access to 50 MW of DR and DER that it can call on. How can it use this capability to mitigate Day-Ahead and Real-Time risks?

Day-Ahead: Our utility may choose to purchase all its uncovered obligations in the DAM, but DAM prices have been known to spike, especially when there is speculation about whether the RTM will be volatile due to scarcity or resource uncertainty. In this instance, it would be unfortunate to purchase a large DA quantity at a high price if the RTM prices drop unexpectedly because the scarcity did not appear. The utility would have been better off relying on Real-Time prices.

Figure 2: DA Strategy – Cover part of DA shortfall in DAM, plan to utilize DR and DER optionality in RT to balance position.

The strategy here is to use the DR and DER to offset some of the uncovered obligations in the DAM. So, instead of purchasing 200 MW, it purchases only 150 MW in the DAM. Now, going into Real-Time, if prices are high or volatile, the utility can trigger the DR and DER resources, which, combined with its DAM purchase, covers its obligation without exposure to Real-Time prices. Conversely, if Real-Time prices are not high and volatile, the utility can simply choose not to deploy the DR and DER and lean on the RTM to cover its obligation. As a result, they’ve saved themselves from purchasing 50 MW of high-priced DA power.

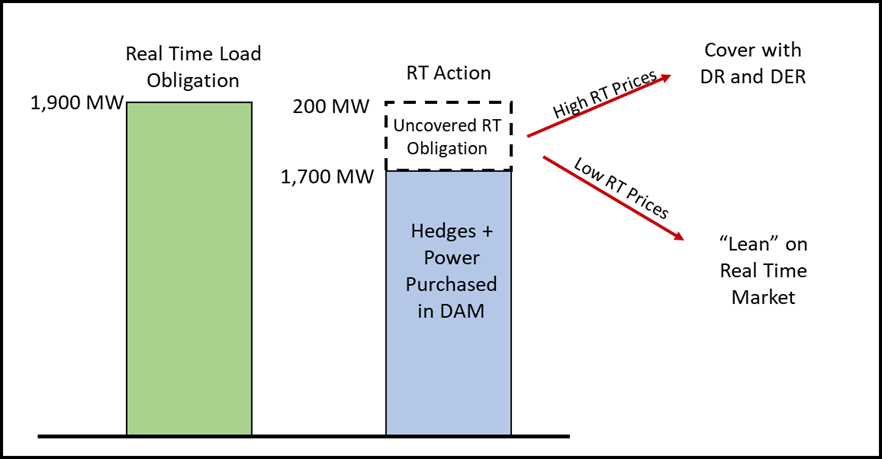

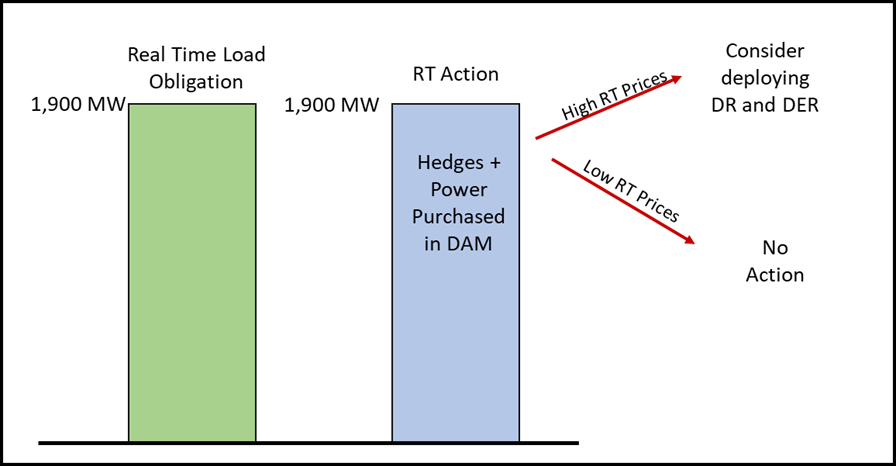

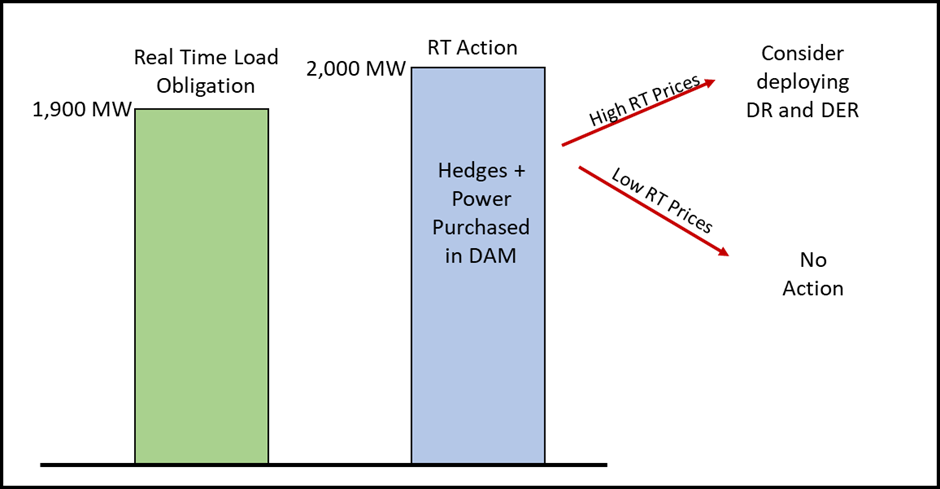

Real-Time: Now, suppose the utility is operating in the Real-Time Market right now. Each hour, it will be in one of three positions: short, flat, or long. Let’s discuss each of these.

- Short: The utility has not purchased enough power to cover its load obligations (whether through its hedges or the DAM). If Real-Time prices are low, this may not be a problem; in fact, it may be a benefit if RT prices are below the DAM or hedge prices. But if Real-Time prices are high and volatile, the utility is paying these prices for its uncovered obligation. This situation can very quickly add up to substantial sums during times of scarcity. But our utility can deploy its DR and DER capability, decreasing load immediately, limiting the exposure, and reducing its costs.

Figure 3: Short Position in RT – Optionality of DR and DER enables a tactical decision to cover offset load in RT if prices are high or do nothing and lean on the Real-Time market if prices are low.

- Flat: The intrepid operators of the utility have forecast the load perfectly and procured the exact amount of power (through the hedges or the DAM or both) needed to serve the load. Huzzah! Does the DR and DER fleet have any value in this case? If Real-Time prices are low, these resources will not be needed and will remain ready for deployment at other times. But if prices are high, the utility can switch these on, reducing its load by 50 MW. Since the utility was flat and is now long, it is effectively “selling back” 50 MW into a high-priced market. This position can turn into a healthy revenue event during scarcity events.

Figure 4: Flat Position in RT – The operator has the optionality of deploying DR and DER to capture revenue if RT prices are high

- Long: If the utility has purchased too much power to meet load obligations, the excess is simply sold back into the RTM (as described above). If Real-Time prices are low, this power may be sold back at a loss. This condition is unfortunate, but it’s sometimes the cost of managing the risk of exposure to the RTM. However, the sell-back revenue will somewhat help offset the original cost of the hedges.

Figure 5: Long Position in RT – The operator has the option of deploying DR and DER to capture additional revenue if RT prices are high.

If prices are high in Real-Time, the utility sells back its unneeded power at a profit. In this instance, it may be wise to go ahead and deploy the DR and DER to further profit from the scarcity in the market. There is absolutely nothing wrong with doing this; in fact, the high prices aim to incent any action possible to help alleviate scarcity. Plus, if the customers who own these resources are on a revenue-sharing program with the utility, they have earned positive returns during this day.

Combined Strategies: No utility has perfect knowledge of the load, prices, renewable energy generation, upcoming forced outages, and the like. Uncertainty in the market will always be present. Sometimes it may be wise to combine these two strategies. For instance, suppose the utility is sure there will be volatility in Real-Time and probably in Day-Ahead as well. They may choose to purchase 175 MW in the DAM, splitting the DR and DER capacity, knowing it will need some of this capability in Real-Time, but still giving it another 25 MW for Real-Time optionality.

Figure 6: Combined Strategy – Split the DR and DER capacity across both DA and RT markets to cover position and enable optionality.

How PCI Can Help

Participation in the Day-Ahead and Real-Time markets is a complex endeavor, prone to risks. Utilities that serve load must be aware of these risks and have plans for mitigating them. Wise use of its DR and DER portfolio can give the utility the needed flexibility to address the uncertainties in load forecasts, price forecasts, and other unknowns that affect the market.

Many companies use PCI GenManager to orchestrate their participation in these markets. Its Bid-to-Bill capabilities ensure seamless sharing of operational, pricing, and position data to enable operators to manage their utilities’ successful participation in these markets. Learn more about how PCI’s Bid-to-Bill Software can help you when dealing with Demand Response and Distributed Energy Resources.