Per its recent Markets Committee Meeting, ISO-NE is proposing Tariff revisions that address the compliance requirements contained in the FERC Order 841 issued February 15, 2018, which addresses Electric Storage Participation in Markets operated by RTOs and ISOs.

FERC Order No. 841 requires ISOs to establish a “participation model” (i.e., market rules) that facilitates the participation of Electric Storage Resources (ESRs) in markets. Facilities may participate as either a Binary Storage Facility (BSF) or a Continuous Storage Facility (CSF), depending on physical characteristics. Note:

- Electric Storage Facilities (ESFs) can bid/offer a minimum of 100 kW as Generator Asset and/or DARD into the Day-Ahead Energy Market Real-Time Energy Market

- All Participants (including ESFs) can take on a 100 kW FRM obligation; Participants can already assign a DARD or Generator Asset in 100 kW increments to meet a FRM obligation

- ESF Generator Assets can offer 100 kW of qualified capacity into the Forward Capacity Market

- ESFs can offer 100 kW of capacity into the Regulation Market

Overview of Changes to Market Rule 1

- New Definitions

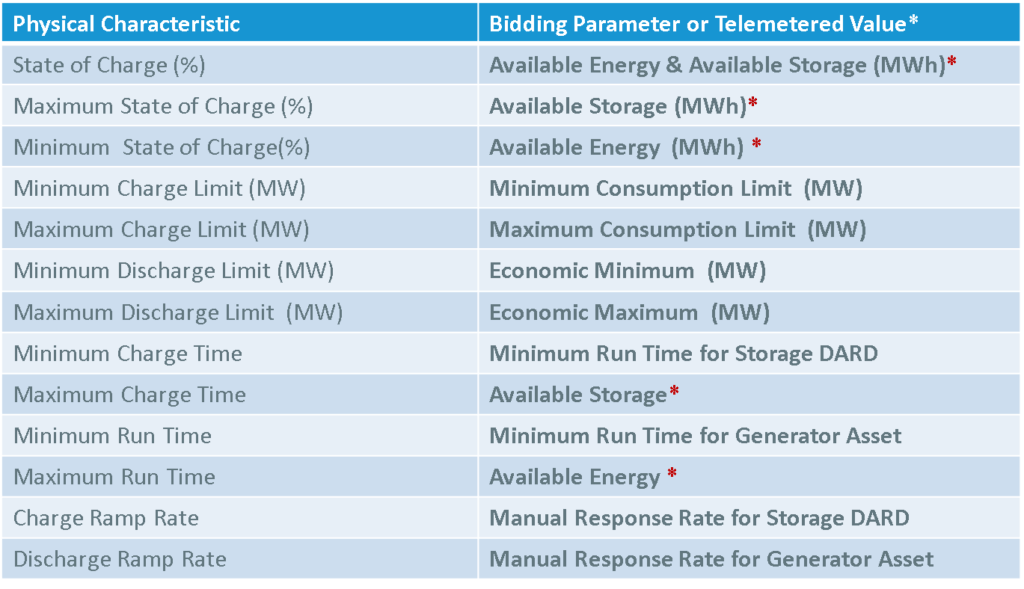

- Available Energy is a value reflecting the MWhs of energy available from an Electric Storage Facility for economic dispatch

- Available Storage is a value reflecting the MWhs of unused storage available from an Electric Storage Facility for economic dispatch of consumption

- Maximum Daily Energy Limit is the maximum number of megawatt-hours that a Limited Energy Resource expects to be able to generate in the next Operating Day

- Lower the minimum size requirement for ESFs

- Lowering the size requirement for Storage DARDs to 0.1 MW

- ESF “should have the ability to inject 0.1 MW and consume 0.1 MW”

- Drop minimum Regulation Capacity of Continuous Storage ATRRs and of Generator Assets associated with Binary Storage Facilities to 0.1 MW

- Lower the minimum size threshold for Generator Assets, DARDs, and ATRRs associated with Electric Storage Facilities from 1 MW to 100 kW

- Lower the minimum bid threshold for the FRM from 1 MW to 100 kW

- Enable all technologies to participate under EFS rules.

- The effective date for DARDs to participate in the Regulation Market: The ISO is proposing to delay the effective date of the implementation of this functionality because of the significant effort to implement and the lack of any requests or interest for a participant to regulate as a DARD.

- Account for the Requisite Characteristics in the Real-time Energy Market (RTEM):

* State variables telemetered to ISO but not included in Supply Offers or Demand Bids

- Account for State of Charge via Telemetered Values in RTEM: ESFs are required to telemeter their Available Energy and Available Storage to the ISO every 4 seconds

- Telemetered Values Ensure a Feasible Dispatch in the RTEM: The ISO typically runs its dispatch system every 10-15 minutes. To ensure that the dispatch is feasible, the Maximum Consumption Limit and Economic Maximum must be re-declared in real-time.

- The day ahead energy market is economically optimized over a 24-hour period based on the bids of market participants. ESFs can bid the same parameters into the day-ahead energy market (DAEM) as they can bid into the RTEM. ESFs have two bid parameters that can be used to account for available energy and available storage in the DAEM.

- Planned Effective Date: Q4, 2019

PCI is at the forefront of all market changes in the Energy Industry, including the changes that will come with FERC Order 841. Our comprehensive solutions cover a broad array of capabilities meant to address the varying needs of different segments within your enterprise and are always current with evolving market changes.