The Treasury Department proposed new rules in December to limit tax credits (known as “45V”) payable to green hydrogen producers under the Inflation Reduction Act (IRA). The proposal lays out three criteria for power that feeds an electrolyzer to qualify for the 45V hydrogen tax credit.

In this blog post, I’ll break down the key proposed requirements, analyze the potential impact on the economics of green hydrogen production, and discuss the implications for producers seeking these credits.

45V tax credit guidance

If approved (they’re currently in a 60-day commitment period), Renewable Energy Credits (RECs) as we know them will not suffice, and even clean nuclear power won’t qualify since very few nukes are under three years old. The rules require a full life-cycle analysis using the 45VH2 version of the GREET model. The EPA responded with a letter to the U.S. Department of Treasury that suggests “three pillar” RECs — those that meet all three of these proposed rules, should be allowed in lieu of the life-cycle analysis.

According to the proposal, clean power sources:

- Must have been placed into service no more than three years ago.

- Must be sourced from the same region as the hydrogen is produced.

- Must be time-matched to production on an hourly basis, meaning that the claimed generation must occur within the same hour that the electrolyzer claiming the credit is operating. Annual matching is permitted until 2028, when hourly tracking systems are expected to be more widely available.

Economic impact of the 45V tax credit

With the 45V tax credit becoming potentially elusive, what are the implications on the Levelized Cost of Hydrogen (LCOH)? A renewable site at best has a capacity factor of 40-50%. An electrolyzer obviously has more production potential using grid power. The IRA hydrogen production tax credit helps compensate for the lower productivity of renewables compared to the dirty grid. How can we determine the LCOH under various scenarios?

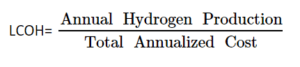

Let’s make some simplifying assumptions and run some back-of-the envelope calculations (these numbers are for illustration only). Let’s begin with the formula for LCOH:

Assumptions

- Electrolyzer Specifications:

- Capacity: 100 megawatts (MW)

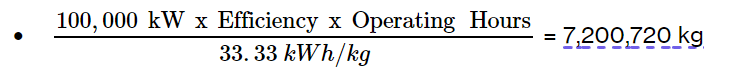

- Efficiency: 60% (typical for proton exchange membrane — PEM — electrolyzers)

- Operating hours: 4,000 hours/year for wind and solar (due to intermittency)

- Cost Components:

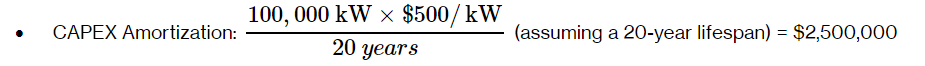

- CAPEX: $500/kilowatt (kW) (typical range for large-scale electrolyzers)

- OPEX: 2.5% of Capital Expenditures (CapEx) per year

- $50/megawatt hour (MWh) for clean energy (decent estimate based on Power Purchase Agreements — PPAs)

- Hydrogen Production: Hydrogen energy content: 33.33 kilowatt hour/kilogram (kWh/kg

Calculations

1. Total Annualized Costs = Annual CapEx + Annual Operational Expenditure (OpEx) + Annual Energy cost

Annual OpEx: 2.5% of total CapEx = $62,500

Annual Energy Cost: Energy Price × Capacity × Operating Hours =$20,000,000

Total Annualized Costs = $2,500,000 + $62,500 + $20,000,000 = $22,562,500

2. Annual Hydrogen Production:

LCOH = $46,362,500/15,769,577 = $3.13/kg H2

The 45V tax credit and the future of green hydrogen

The IRA hydrogen production tax credit impact on the Levelized Cost of Hydrogen (LCOH) is profound. As illustrated by our back-of-the-envelope calculations, the LCOH of $3.13/kg demonstrates the significant role the 45V tax credit can play in enhancing the economics of hydrogen production, particularly when using renewable sources with lower capacity factors.

The tax credit can offset the higher costs associated with renewable energy, making green hydrogen more competitive against conventional sources. (Read up on the colors of hydrogen in our blog post, “Colors of Hydrogen: Economics of Green, Blue, and Gray Hydrogen.)

The stringent criteria for qualifying power sources, coupled with the necessity for an in-depth life-cycle analysis, highlight a shift toward more rigorous and regionally focused renewable energy standards. The future of hydrogen production in the U.S., particularly green hydrogen, hinges on these evolving policies and their alignment with environmental and economic goals.

This dynamic landscape underscores the need for hydrogen producers to stay adaptable and informed as regulations and market conditions continue to evolve. Meeting the strict requirements will be key to accessing the 45V tax credit and improving the viability of green hydrogen projects. Though challenges remain, the credit represents meaningful progress and incentive.

Discover more about hydrogen asset management

Stay ahead in the evolving hydrogen market. Visit our Hydrogen page to learn how PCI’s solutions can help you automate and optimize the management of hydrogen assets within ISO markets and regional hydrogen hubs.