For decades, Integrated Resource Planning (IRP) has been a foundational cornerstone of the utility outlook for the future. Despite the industry’s transformation due to technological advancements and regulatory requirements, the primary objective of IRP has remained substantially similar.

Its mission is to provide analysis-driven long-term planning that provides sufficient resources to satisfy predicted customer needs at the lowest possible cost while considering a variety of supply and demand resources as well as public policy environmental mandates.

While the overall goal has remained the same, IRP has evolved into a complex task involving several key stakeholders and competing agendas.

The unspoken goal has always been to keep the lights on, the public safe, and the economy moving forward.

Resource adequacy.

IRP today poses enormous complexities, risks, and an opportunity due to technological advances, a pandemic, and a polarized political environment fraught with reckless binary dialogue.

Planning Supply-and-Demand for Resources is Complex

Complexity is high when you plan for the supply and demand of integrated resources, as many obstacles can affect whether your plan will work.

Changing Load Profiles – As PCI noted in our blog post about the impact of COVID-19 on electricity demand, the present epidemic and the efforts adopted to restrict the disease’s spread have radically altered our behavioral patterns and modified when, where, and how we use electricity. IRP produces a Resource Adequacy target by combining the Load Serving Entity’s (LSE) peak demand and a designated planning reserve margin. Thanks to teleworking, different regions of the country are experiencing a previously unseen change in load profiles. How long will this last, and to what degree?

Distributed Energy Resources (DERs) – Rooftop solar panels, batteries in electric vehicles used to export power back to the grid, and battery energy storage systems represent three prime examples of technology providing complexity to long-term planning. What will be the rate of adoption of these technologies? Prosumers both produce and consume electricity. How will utility planners gain insight into changing consumption patterns to plan for Resource Adequacy?

Non-Wires Alternatives (NWAs) – Non-wires alternatives (NWAs) are investments and operating practices in electric utility systems that can defer or replace the need for specific transmission and/or distribution projects at a lower total resource cost. It occurs by reliably reducing transmission congestion or distribution system constraints at times of peak demand in specific grid areas. Examples include demand response, energy efficiency, battery storage, load management, and rate design.

Volatility and Reliability Risks

Risk is inherent in the energy world. Volatility, reliability issues, and red tape can all get in the way.

Energy Prices – Forecasts of natural gas and oil, two significant determinants of the cost-effectiveness of various electrical sources, exemplify the risks inherent in today’s IRP.

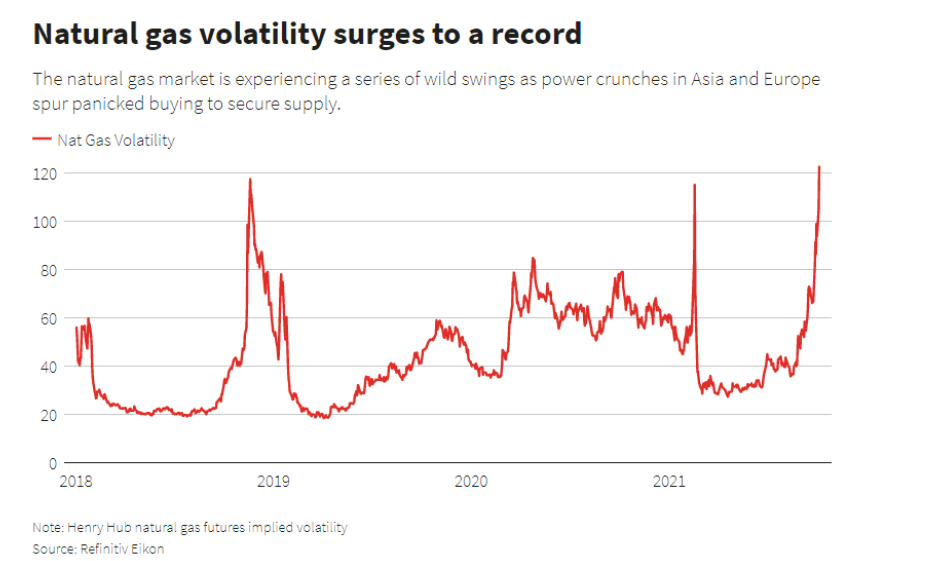

Volatility in U.S. natural gas futures soared to a new high a few months ago due to a global energy shortage that has skyrocketed prices.

Natural gas’s history has been marked by volatility and unpredictability. However, the country has been accustomed to low pricing for more than a decade. Due to low prices, increased reliance on natural gas has allowed long-term planners to shut down coal plants and achieve carbon reduction goals. However, pressure is now mounting on utilities to achieve carbon reduction goals by relying less on natural gas and more on intermittent renewable energy.

Reliability –

According to Paul Cicio, president, and CEO of the Industrial Energy Consumers of America, power quality is “consistently getting worse.”

S&C Electric Company and business consultant Frost & Sullivan’s “2021 State of Commercial and Industrial Power Reliability Study,” the number of businesses impacted by power outages lasting less than 5 minutes increased from 20% to 40% from 2019 to 2020. And 44% of businesses said they lost power on a monthly or more regular basis, which is more than double the number of outages recorded in 2019.

The North America Electric Reliability Corporation (NERC) recently noted that extreme weather is becoming more common. Energy disruptions seen in California last August and in Texas, this February “should serve as a wake-up call for the rest of the country.”

Reliability red flags are popping up across the nation.

The fasten seat belt sign is now on.

Investment Environment- Capital has a funny way of flowing toward places that feel most welcomed. The integration of DERs and NWAs largely depends on the actions of regulators to make investors feel welcome. Will a sufficient rate of return exist? Will a polarizing political climate discourage investments?

Public Utility Commissions (PUCs)- PUCs guide contains critical planning processes affecting a utility’s resource portfolio and environmental profile. In most non-restructured states, utilities must obtain commission permission to construct new facilities or enter into contracts for power.

The Public Utility Commission is expected to represent consumers’ interests (while allowing the utility to earn enough profit). However, since they operate in a highly political setting and regulate one of the most complex processes ever devised by humanity, otherwise known as the electricity grid, regulators can face conflicting incentives.

Public utility commissions face a revolving door problem since each new election result often brings new regulators. So how do utility planners prepare for the future when two political parties often envision a different vision to IRP?

And what about the composition of these regulators?

Most public utility commissioners are not engineers. Most political appointees have backgrounds in law or public service.

While you certainly need lawyers to ensure decisions comply with existing public utility law, what about the need to understand the complexity of how the power grid works fully?

Utility regulators in North Carolina took the unusual step of putting part of Duke Energy’s long-term plans on hold this fall, citing a new state law that would reduce the state’s power-sector carbon emissions by 70% by 2030. This action puts the state on track to become carbon-neutral by 2050. But are regulators educated enough about the electrical grid to ensure reliability and resilience?

Customer Trust Leads to Opportunities

The human behavior and analytics firm Escalent published a study examining the historic high in customer utility trust due to the industry’s effective response to the pandemic.

“It is clear from our research that the utility industry has done a fantastic job supporting customers during the pandemic. This has won utilities their customers’ trust and goodwill,” said Chris Oberle, senior vice president at Escalent. The utility industry is used to handling crises and quickly providing customer support.

Before the pandemic, many futurists predicted that the age of digitalization would leave utilities in the dust. Giant, global, high-tech companies would step in between the utility and their customer to form a new relationship by sharing demand data from homes and businesses.

But the futurists missed two significant points:

First, people love their technology and social media, but they don’t trust it.

And second, people haven’t always loved their local utility, but they do trust it.

Trust is the cornerstone of any lasting relationship, and without it, all the money, technology, and algorithms in the world are meaningless.

The utility industry’s response to COVID-19, notably not shutting power off to the newly unemployed living paycheck-to-paycheck, has earned them a significant trust dividend. As a result, customers now expect utilities to be their energy advisers and invest in the earned trust dividend in advancing new energy efficiency opportunities.

Compare the efficiency of various power sources in our blog post:

Utilities own a unique opportunity to directly have a meaningful conversation with their customers and involve them in IRP. Retail and industrial customers need to hear the benefits and costs of rapidly shifting away from thermal generation.

Power costs across the Atlantic Ocean rose five times the historical average for most of 2021 due to a jump in natural gas and carbon prices.

As a result of the uncertain output of renewable assets and a tight supply-and-demand balance in the European power grid, price volatility is reaching unprecedented heights. For utilities, dealers, and large power consumers, navigating this new normal will be a significant challenge, emphasizing the significance of building robust power-asset portfolios and controlling risk.

Utilities stand on the cusp of a shift to renewable energy resources. 2022 Integrated Resource Planning in the United States will be looking to navigate a similar challenging environment in the future.

If you enjoyed this blog post, check out the following related posts.

- 2021: Revaluing Reliability & Resilience

- Flattening the Demand Curve

- Power Plant Efficiency: Coal, Natural Gas, Nuclear, and More