Companies in the energy and power industries must contend with volatile commodity prices while providing stable and reliable services to their customers on their journey to net-zero. Such challenges have become ever more apparent and immediate given the current geopolitical crises that have upended natural gas markets in Europe and around the world. A common strategy for mitigating commodity price risk tends to focus on building more renewable power generation. Hydrogen, with the recent and future advances in electrolyzer technologies and major investments, planned for large-scale projects, has become an indispensable option in energy and environmental strategies that integrate the various sectors in energy markets.

My first blog post on the hydrogen decade began by stressing the importance of sector coupling for legacy infrastructure as an immediate first step and fundamental to proper hydrogen market planning and formation. This follow-up post will introduce the functional role arbitrage can play in asset integration strategies and the commodification of hydrogen on a global scale.

Arbitrage as a Mitigation Strategy for Compound Risk

Compound risk has escalated from ongoing concerns to cascading crisis episodes in the following ways: existential volatility in the geopolitical landscape, widespread exposure to cybersecurity disruptions, acute energy and power supply shortages, growing supply chain scarcity, mounting natural resource constraints, and catastrophic weather events. These risks have all conspired to create historic levels of unmanageable price inflation and extreme hardship.

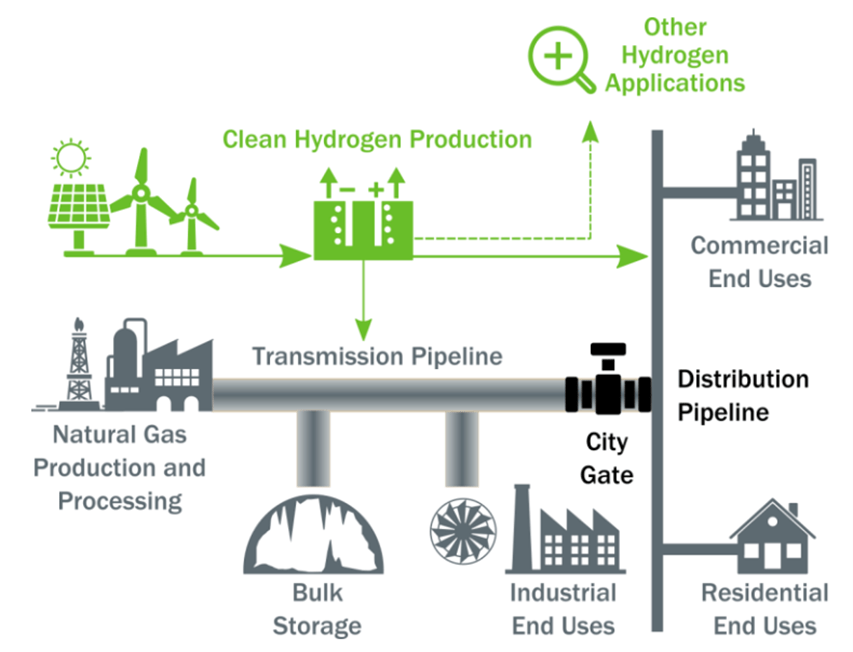

Risk superclusters have the potential of compounding even further as chaotic markets function in an increasingly complex transition toward a decarbonized energy system. Hydrogen arbitrage can be especially effective for markets that are experiencing extreme price fluctuations and supply constraints or disruptions. When natural gas prices spike, the production price for low-carbon blue hydrogen — which is produced through pyrolysis, steam methane reforming (SMR) with carbon capture, or autothermal reforming (ATR) — can exceed the production costs of green hydrogen produced with renewable energy resources which can be used for storage and blending into existing natural gas infrastructure.

Learn all about the many colors of hydrogen in our blog post: Economics of Green, Blue, and Gray Hydrogen

Courtesy U.S. DOE: “HyBlend, Supply Chain Components of Blending in Natural Gas Networks”

Hydrogen Is Scalable for Enhanced Fuel Diversity

Much like natural gas, hydrogen offers fuel diversity as a gas or liquid, which creates new commodity streams that can integrate with existing physical and digital assets. Cross-border export potential provides critical dual fuel options by displacing natural gas imports from geopolitical adversaries with low-carbon and renewable hydrogen produced by trusted trading partners.

The continued rapid ascent of hydrogen from a niche market to a globally traded commodity reached a significant milestone when S&P Global Platts released its Hydrogen Price Wall that tracks over 60 regional prices and month-on-month changes. Early potential trade routes emerge as technologies and regions compete to produce the cheapest renewable hydrogen through electrolysis or low-carbon hydrogen. The price wall currently compares prices from the U.S., Asia-Pacific, Europe, and the Middle East and is a critical first step for price transparency, product certification, and emissions reduction accounting as hydrogen begins to find its footing as a global commodity.

Additionally, Goldman Sachs recently published the report, “Carbonomics: The clean hydrogen revolution,” for an aspirational global net-zero path that values the total addressable market (TAM) for clean hydrogen generation alone as US$250bn by 2030E and US$1tn by 2050E with a 15% reduction in global greenhouse gas (GHG) emissions.

Scalability rates are also included as the report highlights a 100x increase in average project size in the green hydrogen projects pipeline from 2MW in 2020 to >200MW by 2025E and GW scale by 2030E.

Affordability is rapidly improving with cost parity between green and gray hydrogen of US$1.5kg H2 by 2025E, along with cost deflation of 40% for electrolyzers.

Resilience and fuel diversity are also embedded in global hydrogen market design and planning, with 30% of global production volumes having the potential for cross-border transport that could positively impact overall energy system reliability amid projected geopolitical patterns.

These growth, price, and export indicators align with the following projection from the Hydrogen Council and McKinsey & Company, which shows a major shift from low-carbon to renewable hydrogen by 2030.

The Blue-Green Transition Toward Decarbonization

Decarbonization pathways include Scope 1, 2, and 3 emissions for the producer, buyer, and consumer in the hydrogen value chain. So, renewable hydrogen that powers an industrial plant can achieve reductions across the full sequence that may include tradeable or redeemable carbon credits. Government policies, energy, and power companies, and market forces like ESG investors are driving the trajectory of the blue and green production curves, with the projected initial crossover point from low-carbon to renewable hydrogen occurring in 2025.

Many asset owners and project developers have anticipated this blue-to-green transition and have designed dual-fuel project configurations that blend renewable hydrogen into natural gas technologies and infrastructure. The Hydaptive™ package by Mitsubishi Power provides renewable energy flexibility by acting as a near-instantaneous power balancing resource that greatly enhances the ability of a simple cycle or combined cycle power plant to ramp output up and down to provide grid balancing services. It integrates a hydrogen and natural gas-fueled gas turbine power plant with electrolysis to produce green hydrogen using 100% renewable power and onsite storage of green hydrogen.

The Hystore™ package combines the Hydaptive™ package with access to large-scale off-site hydrogen production and storage infrastructure, enabling large-scale renewable energy storage that shifts variable renewable energy over time, from hours to seasons and provides reliable and cost-effective carbon-free energy when the grid needs it most. Hydaptive and Hystore present an ideal project footprint for analyzing natural fuel diversity and hydrogen blending for ever-increasing percentages up to 100%, which will improve arbitrage opportunities for both natural gas and renewable hydrogen.

Maximizing the Value of Hydrogen Assets

The global movement toward decarbonized and sustainable economic growth and development is occurring at a time of unprecedented uncertainty and volatility. It’s impossible to advance this transition without software programs that manage existing assets and natural fuel diversity dynamically and profitably while also mitigating environmental challenges. Operating a fleet of networked hydrogen, natural gas, and power generation assets will be a challenge. Maximizing the value of these assets in dynamic and volatile interconnected commodity markets will be even more difficult. Companies will need tools such as PCI’s GenTrader portfolio optimization software, ETRM solution, and Hydrogen optimization software to manage the physical and financial positions in order to fully capture cross-commodity arbitrage opportunities, effectively mitigate commodity price risks, and achieve net-zero emissions in the future.

We recently hosted an educational webinar, “Hydrogen Power: Opportunities & Challenges.” If you missed it, request the slides!

David B. Grantham is the founder of RedwoodAdaptive, an energy and environmental consultancy located in Norman, Oklahoma.